The global private equity market has undergone dramatic expansion over the past decade. Whether measured by fundraising (firms received $385 billion of new capital in 2018), assets under management (which now exceed $3.4 trillion worldwide), or total number of private equity firms (7,775 in 2018), the private equity asset class has experienced impressive growth.

We have seen an ongoing maturation of the private equity industry as capital continues to flow to the asset class in search of attractive returns. The largest buyout firms – sometimes referred to as ‘mega-firms’ – have attracted a growing share of capital inflows and have in many cases become diversified asset managers. In the mid-market, there has been increasing specialization among managers to focus on particular sectors, industries, or strategies. The market also faces some headwinds as the economy enters the later stages of the cycle, with high deal multiples, slowing investment pace, and difficulties accessing top-tier managers due to high investor demand.

This growth and increased complexity present both challenges and opportunities for investors. Those seeking private equity exposure need to choose which market segment to focus on, and how to best access their chosen segment to achieve the highest possible returns. We believe that in today’s highly competitive environment, the best returns will be generated through a focused, comprehensive mid-market strategy that is able to leverage the synergies and information flows afforded by a broader private markets platform.

The mid-market advantage

Mid-market companies — defined as those with annual revenues from $10 million to $1 billion or with enterprise valuations falling within roughly the same range — remain the economic growth engine of the global economy. Within this mid-market universe are a myriad of companies with positive cash flow and EBITDA between $10 million and $100 million offering potential investment opportunities. The number of such companies has risen in recent years: in the US, there are 200,000 companies generating revenues of between $10 million and $1 billion. These companies employ three out of four US workers and account for almost 43% of all revenue generated by US-based businesses. A similar picture exists in Europe, where mid-market companies contribute more than €1 trillion to the European Union GDP.

Within this large and growing opportunity set, mid-market investment opportunities come in many forms. These include the following: successful founder- or family-run businesses in search of first-time institutional capital to manage generational change or to fund growth initiatives; publicly listed companies that have been undervalued by the market due to size; and operating divisions that can be carved out of larger corporations. The investment opportunity that these companies present is significant.

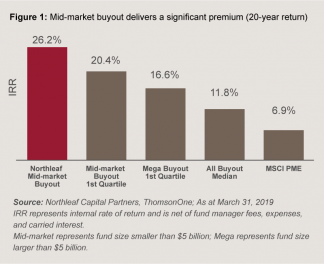

While historically private equity returns have generally outpaced other asset classes (including public equities), the potential to capture a return premium is particularly evident in the mid-market segment. Figure 1 provides an example, illustrating the returns that Northleaf ’s global private equity program has generated from its investments in North American and European mid-market private equity funds over the last 20 years. The returns from this mid-market strategy have not only outperformed the public markets by a significant margin but have also exceeded the returns of top-tier mega buyouts over the same period. Adding mid-market secondary and direct private equity investments makes the return premium even greater.

The return benefits of the mid-market relative to the large and mega market have been an enduring feature of the private equity landscape. There are several reasons for this, including the following: (i) the opportunity set (i.e. number of target companies) is larger and the market is less efficient; (ii) there is greater scope for operational value creation; and (iii) there are more exit alternatives.

The substantially larger target universe of potential investee companies in the mid-market as compared to the larger end of the market creates a more favorable balance between opportunity and capital availability. Consequently, M&A activity in the mid-market has proven more resilient to economic and credit cycles than large market activity, where transactions rely more on financial engineering and the availability of significant leverage. The mid-market has seen consistent and robust transaction activity regardless of macroeconomic trends, credit availability, or public market volatility. Mid-market transactions tend to be less intermediated, creating increased opportunities for fund managers to secure proprietary deals outside of auction processes and to leverage industry relationships, sector expertise, and informational advantages. As a result, purchase price multiples tend to be lower than in other market segments.

Mid-market companies provide greater scope for value creation through hands-on operational improvement initiatives undertaken by fund managers. Smaller companies are often undermanaged and subscale, offering significant opportunities for value enhancements, which can come in a variety of forms. To capitalize on this opportunity, many mid-market fund managers have developed in-house expertise in areas such as procurement, pricing, digital marketing, and even advanced analytics.

On the back of these value creation initiatives, mid-market fund managers can benefit from selling larger, better-managed businesses – and this generally drives an expansion of valuation multiples on exit. Mid-market fund managers also benefit from numerous possible exit routes for their portfolio companies, whether it be selling to strategic buyers, financial buyers, or portfolio companies of larger PE firms, or taking companies public through an IPO.

While the mid-market represents an attractive investment opportunity, there are several issues for institutional investors to consider when building exposure to this segment. Chief among these is that mid-market companies are more susceptible to business risk. For example, mid-market companies may be earlier in their organizational development and therefore more vulnerable to shocks due to high customer concentration, reliance on key employees, or lack of reliable operational and financial reporting. This reality has led to a higher dispersion of returns in the mid-market compared to larger, more established companies. Given these risks, investors interested in mid-market exposure require strong organizational resources and expertise if they are to execute such a strategy effectively.

Funds and beyond — building a fully integrated mid-market private equity platform

Like the rest of the private equity asset class, the mid-market segment has become more complex, resulting in new, more nuanced investment opportunities. While it is attractive as a standalone program, a mandate that is focused solely on primary fund investments and opportunistic direct co-investments does not provide investors with the flexibility to participate in certain emerging niches of the private equity mid-market. In recent years, there has been significant evolution in the secondary market as well as growth in the volume and complexity of direct investment deal flow. These complementary strategies provide mid-market private equity investors with new options through which to augment their investment programs, but also require different skill sets.

The volume of secondary transactions has tripled in the last decade, from $20 billion in 2008 to $70 billion in 2018. Some of this increase has been driven by new types of ‘GP-led’ transactions to provide fund-level liquidity, but more traditional limited partner-driven portfolio sales have also grown as investors continue to implement active portfolio management strategies. From an investor standpoint, the secondaries market is an attractive complement to a primary fund investment program because it provides greater vintage year diversification, immediate investment exposure, a more rapid return of capital, and the potential for immediate valuation increases – all of which serve to mitigate the typical ‘J-curve’ of negative early returns from primary fund investments. A secondaries program of sufficient scale also provides investors with proprietary information and relationship advantages that may help drive better primary fund returns (and vice versa).

Direct investments have traditionally consisted of direct co-investments, where the investor is a limited partner in a fund and invests alongside the fund’s manager in a transaction, often on a no-fee, no-carry basis. This has been an effective tool for investors seeking to ‘average down’ the cost of their private equity program and gain access to high-quality deals. However, the market for co-investments has become very competitive and investors now need to differentiate themselves through a demonstrated ability to react quickly to opportunities presented by fund managers, without becoming vulnerable to adverse selection. While the competition for traditional direct co-investments has become more intense, other attractive direct investment options are emerging. These include investing alongside independent or emerging sponsors, pursuing structured equity transactions, and entering more concentrated secondary opportunities (which, because of the focus on a small number of underlying companies, effectively resemble direct investments).

Although new types of secondary and direct investment deal flow have emerged for investors to augment their traditional private equity fund investment programs, it can be challenging to participate effectively in these more specialised and complex transactions. The secondary and direct investment markets differ from primary fund investing in that deals must be underwritten based on the quality of the underlying assets. They both, therefore, require sophisticated origination, structuring, and diligence expertise, as well as investment teams that can conduct independent company-level due diligence and respond within expedited timeframes. These additional capabilities and increased processing capacity are key success factors for any investor seeking to participate in the attractive return potential of these emerging transaction types.

Private equity and beyond — the benefits of an integrated private markets investment platform

Institutional investor success in private equity has paved the way for growth in allocations to other private market asset classes (including private credit, infrastructure, and real estate) as institutional investors search for a return premium to complement their traditional public equity and fixed income asset mix. The emergence of private credit and infrastructure, in particular, has created the potential for synergies with private equity in deal origination, information flow, networks, due diligence expertise, and investment structure. The ability to leverage the knowledge and expertise across private markets asset classes has significant benefits for investors as private markets strategies converge, particularly in the less efficient mid-market segment.

Private credit is a particularly interesting complement to private equity, as lending to PE-backed companies has long been a key feature of the private credit market. A private credit platform that lends directly to PE-backed mid-market borrowers provides private equity investors with clear relationship, informational, and deal flow advantages. In the mid-market, these synergies are most abundant when the private credit strategy is paired with a diversified, global private equity portfolio of funds, secondaries, and direct investments, as opposed to a direct, control-oriented private equity strategy with a far narrower portfolio and scope. A strong private credit business that has a broad view over current market activity yields insights into fund manager behavior and preferences, as well as real-time market feedback on both sector and company-level performance drivers. The origination coverage and ongoing dialogue with fund managers is highly complementary and there are clear relationship synergies across the two strategies, which can assist with deal sourcing, due diligence, and ongoing monitoring, valuation, and reporting.

While less obvious, the potential synergies between private equity and infrastructure (or other real asset strategies) are no less powerful, in part because of the increased scale, expertise, and resources available across a broader private markets investment platform. At the company level, infrastructure and other real asset classes have developed and depend upon a substantial number of supplier and service-related businesses, which are attractive targets for investment by private equity funds. At the sector level, there has been a convergence in recent years where certain industries – including parking, mid-stream energy, and merchant power generation – have been targeted by both ‘value-add’ infrastructure funds and traditional private equity managers.

Conclusion

Mid-market private equity remains both a highly rewarding and increasingly complex investment strategy. As the segment continues to evolve, an integrated approach that combines top-tier mid-market primary fund investments with an ability to source and execute accretive secondary and direct investments will be crucial to future success. Private equity investors who can also leverage an integrated private markets platform that includes synergistic private credit and infrastructure capabilities will enjoy a unique competitive advantage.