Introduction to Private Equity Secondaries: Laying the Groundwork

Secondaries are a growing part of the private equity landscape that offer a range of ways for investors to access privately-owned companies and assets with the potential for attractive risk-adjusted returns. However, successfully allocating to private equity secondaries within a portfolio requires an understanding of the different investment types and the elements to consider when evaluating these opportunities.

This article introduces core secondary investment concepts, including the differences between LP-led and GP-led secondaries and factors to consider as investors seek to build exposure to private equity secondary strategies.

Introduction

The secondary market has seen significant growth over the past two decades as the motivations for sellers turning to the secondary market have evolved and led to increased deal flow. Secondary investments are transactions where an investor buys another investor’s interest in a private equity fund or certain companies within a fund. Historically used as a last resort for distressed or forced sellers, secondaries have become a broadly accepted tool enabling active and systematic portfolio management for inherently less liquid private equity investments.

Secondaries can offer many attractive features, including reduced blind pool risk, j-curve mitigation and historically, low volatility. However, not all secondaries are created equal. Secondary transaction types vary based on key attributes, including diversification, asset quality, cash flow characteristics and fund manager alignment. This article explores some of the key elements investors should consider when determining how to allocate to a private equity secondary strategy that effectively meets their portfolio objectives.

Growth in the Secondaries Market

The number of private companies far exceeds the number of public ones. In the United States, for example, for every publicly listed company, there are nine privately-owned companies.1 The challenge for investors is how to access this large pool of private companies in an efficient and well-diversified manner.

Historically, blind-pool commitments, or primary commitments, to private equity buyout funds have been the most common way that investors have gained this access and the related benefits. By pooling capital from multiple investors, or Limited Partners (“LPs”), funds invest in a portfolio of privately-owned companies or assets that may otherwise be out of reach for investors. LPs aim to benefit from the expertise of the fund manager, or the General Partner (“GP”), who handles the complexity of deal sourcing, asset selection, due diligence, value creation and ongoing monitoring.

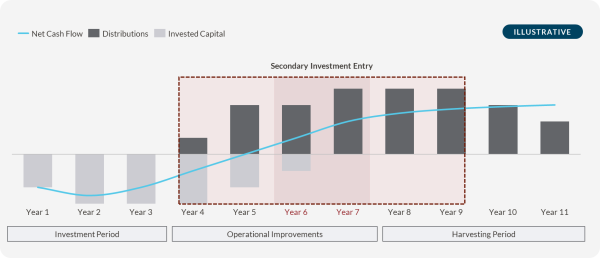

These traditional private equity funds typically have longer time horizons, often lasting over ten years, to allow the assets in the portfolio to mature and achieve their potential value. However, this means that a portion of investors’ capital may be locked up until the fund is fully liquidated, as shown in Figure 1 below, which can create a sub-optimal cash flow profile for some investors.

Figure 1 - Private Equity Fund Lifecycle

This is where secondaries can be a useful tool. Secondaries are increasingly gaining traction as a way for LPs to proactively manage their liquidity and portfolio diversification through “LP-led transactions.”

The defined time horizon of many funds can also introduce challenges for GPs. Companies can grow and mature at a different pace for a range of reasons, from market conditions to company-specific circumstances. This can lead to a company not reaching its target value and return to fund within the originally underwritten time horizon. Alternatively, if a fund owns a high-quality, high-performing asset with further upside potential, a GP might want to retain the asset beyond its original expected time horizon to capture the full value of its operational improvement efforts. In these circumstances, a GP might turn to the secondary market to structure a “GP-led transaction” that provides a liquidity option for existing investors, while also extending the life of an investment.

As a result of this increased level of adoption, private equity secondaries have continued to gain attention as a core allocation for many investors. With the market reaching $160 billion in volume in 2024,2 and on pace to potentially exceed $200 billion in 2025, secondaries are one of the fastest-growing segments within alternatives.

Comparing LP-Led and GP-Led Secondary Opportunities

As described above, the private equity secondaries market can be split into two main investment types: LP-led secondaries – where an LP is selling an interest it holds in an already established fund, and GP-led secondaries – where a GP creates a new vehicle to offer current investors an option to sell and new investors an option to buy exposure to an existing company or portfolio of companies it wants to retain.

Below are some of the key attributes of LP-led and GP-led secondaries that are relevant in weighing the relative benefits and considerations of building exposure.

| Attributes | LP-Led Secondaries | GP-Led Secondaries |

|---|---|---|

| Diversification | More diversified Typically involve portfolios of several funds and underlying companies, providing potential for instant diversification across GPs, funds, companies, sectors, geographies and vintages. | Less diversified Offer less diversification as they are typically focused on one or more prized assets from a single GP. |

| Attractive Entry Point | Offer discounts usually ranging from 5%-25% from LPs looking to secure liquidity. | Offer relatively modest discounts, usually ranging from 0%-10%, as they tend to include prized assets with high growth potential. |

| Typical Cash Flow Characteristics | Earlier and more regular distributions Typically offer a relatively quicker path to liquidity as secondary investors step into the shoes of the seller midway through the fund’s life. Portfolios often consist of mature or maturing funds with some companies close to exit or already realizing distributions. | Later and lumpier distributions Typically longer duration as GPs are looking to hold assets for 3-5 years to build value; however, this is still likely to be quicker than a primary commitment to a traditional private equity fund. Liquidity depends on fewer exit events, given that these vehicles typically hold one or a small number of companies. |

| Asset Quality | Variable and portfolio-specific Given the diversified portfolio nature, quality can be mixed. It is important to consider the underlying company quality and ensure it is factored into due diligence and pricing. | Typically higher quality As previously noted, most GP-led transactions are focused on higher-performing “trophy” assets which, while more concentrated, are also typically higher quality than more broadly diversified LP-led portfolios. |

| Fund Manager Alignment | Variable and portfolio-specific Stepping into the shoes of an existing LP midway through a fund’s value creation journey is naturally less aligned than entering at the fund’s inception. Understanding alignment dynamics with GPs and the range of economic outcomes is an important component of LP-led due diligence. | Typically structured to be strong Alignment is typically higher. The GP will often roll over all or a large proportion of its economics at the same cost basis as new investors. Motivations behind a GP-led transaction are important to evaluate in due diligence in order to understand alignment. |

| Reduced Blind Pool Risk | Both LP-led and GP-led secondaries involve buying into an existing company or portfolio of companies where the underlying investments are known and the performance history can be evaluated in due diligence. This contrasts with a primary commitment to a private equity fund, which is made at the fund’s inception and before the underlying portfolio is invested. | |

| J-Curve Mitigation | Both LP-led and GP-led secondaries mitigate the j-curve by allowing investors to buy seasoned assets that are typically already producing steady cashflows with offset fees associated with the investment (refer to Figure 1 above). This contrasts with a traditional primary commitment to a private equity fund, which is likely to generate a negative return in its first few quarters as fees are drawn before the portfolio begins generating returns. | |

The characteristics highlighted above are illustrative and may not be present in a specific LP-led or GP-led transaction.

Weighing the Portfolio Management Benefits of LP-Led and GP-Led Secondaries

A common benefit of both LP-led and GP-led secondaries is that they reduce or eliminate blind pool risk. This visibility provides secondary fund managers with the opportunity to construct a portfolio of investments that achieves a targeted level of diversification across companies, sectors, geographies, and vintages.

Both LP- and GP-led secondaries can offer attractive risk-adjusted returns more quickly than making primary investments in private equity funds. Relative to GP-led transactions, LP-leds typically achieve a lower multiple, but deliver distributions more quickly. They also offer an ability to build exposure to prior vintages and allow investors to jumpstart a private equity program quickly and efficiently.

On the other hand, GP-led transactions can provide more concentrated exposure to high-quality companies with the potential for higher absolute returns. Understanding the characteristics that lead to success in GP-led secondaries is essential in mitigating the risk posed by their concentrated nature. Factors including familiarity with the underlying assets and GP alignment are key in limiting the downside and improving the upside return convexity for these opportunities.

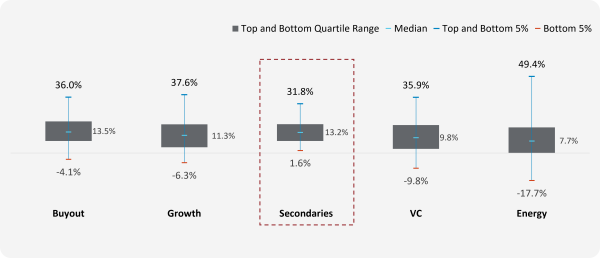

Both LP-led and GP-led secondaries can provide an attractive, diversified, and lower risk way to gain exposure to private equity. As Figure 2 below shows, private equity secondaries have historically delivered lower volatility across market cycles compared to other strategies.

Figure 2 – Dispersion of Net IRRs by Private Capital Strategy

Source: Cambridge Associates; 2001–2020 vintages, net IRRs of all fund vintages globally included in the Cambridge Associates database across each respective asset class as of September 30, 2024. The Cambridge information provided is not transparent and cannot be independently verified. The funds included in the private capital data shown report their performance voluntarily, and therefore, the data can reflect a bias towards funds with track records of success.

In summary, LP-led secondaries can be a liquidity-enhancing, highly diversified, and low-risk way to invest in private equity. GP-led secondaries aim to play the role of a more concentrated, high-conviction return enhancer in an investor’s portfolio. These investments provide alpha-seeking tactical exposure to known, high-performing assets with aligned and high-quality GPs.

Conclusion

As the secondaries market continues to mature, with supply driven by both macro events and portfolio management decisions, compelling investment opportunities will continue to emerge. For investors looking to build their exposure to private equity secondaries and capture the potential benefits, understanding the differences between LP-led and GP-led secondary investments is essential. While each can provide opportunities for investors to achieve quick exposure to the potential returns of private equity, they play different strategic roles in portfolios. Investors need to determine how each type of secondary aligns with their investment objectives.

Endnotes

Source: Capital IQ/NAICS association data as of December 2024. Segmented by size of revenue between $250 million and $1 billion.

Source: Evercore Private Capital Advisory, FY 2024 Secondary Market Review.

Important Notices

This whitepaper is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. All information is subject to change without notice.

The views and opinions expressed herein should not be construed as absolute statements, do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. No representation, express or implied, is given regarding the accuracy of the information contained in this whitepaper and there can be no assurance that any of the trends highlighted herein will continue in the future. Certain of the information in this whitepaper was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.

Notwithstanding the advantages of secondary investments, investments in the types of deals described herein are subject to significant risk of loss of income and capital. This whitepaper may contain forward-looking statements based on experience and expectations about these types of investments. For example, such statements are sometimes indicated by words such as "expects," "believes," "seeks," "may," "intends," "attempts," "will," "should," and similar expressions. Those forward-looking statements are not guarantees, and are subject to many risks, uncertainties and assumptions that are difficult to predict.

This whitepaper may not be reproduced or republished without Northleaf’s written consent. Northleaf Capital Partners and its affiliates are referred to collectively as “Northleaf” throughout this document Northleaf Capital Partners® and Northleaf® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.