Private Equity Market Update: Q3 2024

Mid-market private equity presents an attractive and diversified opportunity, fueled by favourable tailwinds in the secondary market and renewed confidence in a strengthening macroeconomic environment.

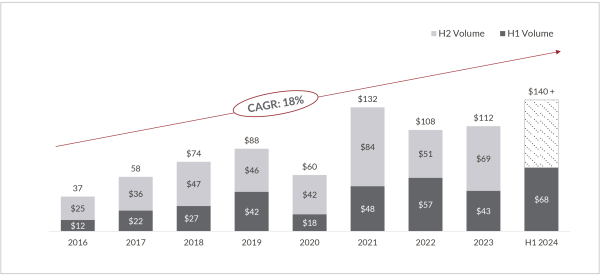

The secondary market saw its long-anticipated resurgence in the first half of 2024 as bid-ask spreads narrowed, unlocking significant pent-up transaction volume. Annual volumes are on track to surpass $140 billion this year driven by growth across both LP and GP-led transactions.1

LP-led transaction volumes were predominantly driven by ongoing liquidity pressures while GP-led transactions saw significant increases due to strong market demand and GPs seeking to generate distributions while retaining their top-performing assets.

Historical Secondary Volume1

US$ Billion

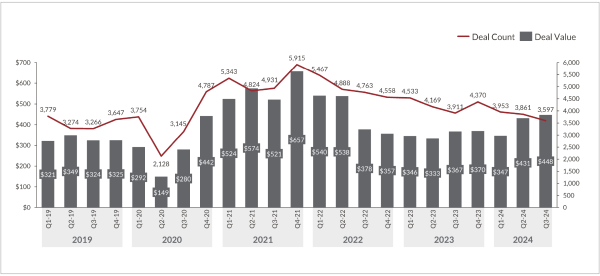

Deal activity is showing signs of recovery as the first three quarters of 2024 saw a meaningful increase in deal values after a slower 2022 and 2023. Deal values increased by 17% while deal count declined by 10% in the first nine months of 2024 compared to the first nine months of 2023.2

Recent interest rate cuts should provide a tailwind for sponsors and the broader M&A market, boosting investor confidence in both the macroeconomic environment and deal valuations. While we expect exit activity to pick up, it will take time for the build-up of net asset value (NAV) to work its way through the system.

Global Private Equity Deal Activity2

US$ Billion

In many ways, the secondaries market is serving as an important relief valve for the private equity industry, which appears to be out of equilibrium. The run-up in private equity NAV between 2018 and today has been dramatic. This, coupled with a slowdown in exit activity, has left many LPs in a cash-negative position and looking for paths to liquidity. These dynamics have created a favourable environment for the secondaries market that we anticipate will persist over the medium term.

1. Source: Jefferies, Secondary Market Update, July 2024.

2. Source: Pitchbook Global Private Equity Deal Activity, October 2024.

Important Notices: This document is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. The views and opinions expressed herein do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. There can be no assurance that any of the trends highlighted above will continue in the future, Certain of the information set forth herein was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.