Asset-Based Specialty Finance: A Unique Value Proposition in Private Credit

Introduction

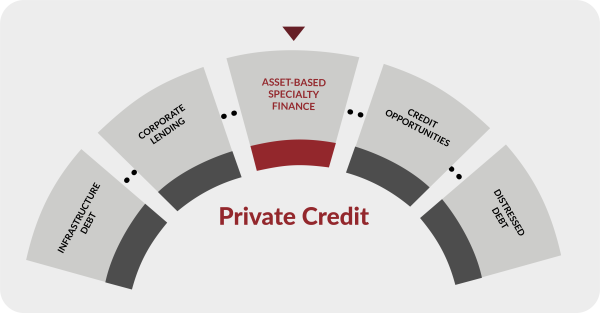

Private credit encompasses a range of strategies and investment opportunities, and asset-based specialty finance (ABSF) sits in a unique part of this landscape from a risk/return perspective.

ABSF's value proposition is largely driven by characteristics such as favourable supply/demand dynamics, diversification, and wide-ranging structure and lending protections, which create the potential for downside risk mitigation. While the return profile can often align with opportunistic or distressed strategies, ABSF is typically collateralized by portfolios of performing assets, consistent with traditional lending.

Many credit investors view ABSF as a natural extension of direct lending given the contractual return and well-managed risk of the asset class. ABSF may also provide complementary exposure by way of enhanced diversification, elevated yield and muted volatility within a broader private credit portfolio.

The Growth of ABSF

ABSF is a growing segment that covers over $5.5 trillion of funding across the global economy1. Since 2008, and in the wake of the Global Financial Crisis, the ABSF market has continued to mature as traditional banks narrow their lending focus and borrowers increasingly look to private markets for flexible and customized financing solutions. Today, the most mature and active ABSF markets are the US, the UK, Europe and Australia.

The market is commonly segmented into consumer, commercial and niche asset categories, each offering investors unique and diversified exposure with varying return, correlation and risk characteristics. Importantly, ABSF investments are collateralized by diversified pools of cash flow-generating financial or hard assets that have historically provided strong downside management.

Unlocking Value Through Debt-Focused, Niche ABSF

Niche ABSF offers enhanced portfolio diversification as niche assets can exhibit idiosyncratic demand and risk drivers. Asset performance is typically less correlated to the broader market and credit risk is less influenced by factors such as unemployment, GDP or interest rates.

A debt-oriented focus on niche assets represents a particularly interesting intersection within the ABSF opportunity set, with well-structured investments offering significant collateral coverage and robust lender protections.

Several features help deliver this value proposition:

High Cash Yield

Niche asset verticals require a high degree of underwriting and structuring specialization. Consequently, these segments tend to be under-financed by traditional and generalist capital providers, including banks and the securitization market. The combination of asset specialization, structuring expertise and investing in asset verticals that attract less institutional capital coverage has historically resulted in strong risk-adjusted returns with a focus on cash yield.

Downside Management for Lenders

Highly negotiated and customized structures provide downside management for lenders through:

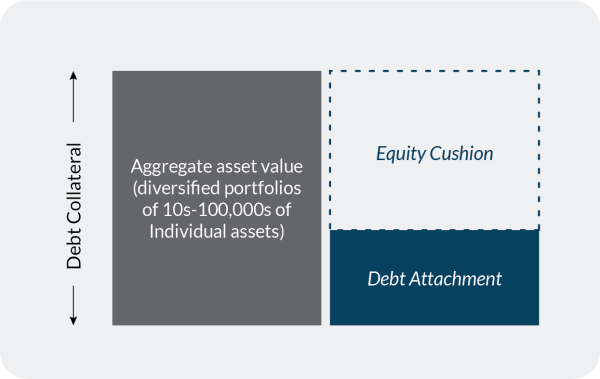

Overcollaterization

Senior loans are typically covered 2-3x by the asset value (or 30-50% LTV) resulting in significant overcollateralization and equity cushion.Diversified Collateral Pools

Highly diversified collateral pools of 10s-100,000s of individual assets mitigate binary performance risk.Customized Structuring and Rigorous Monitoring

Eligibility/concentration limits ensure governance of the borrowing base and quality and diversification of collateral. Debt investments often benefit from additional lender protections including multiple financial covenants, call protection/ minimum MOIC, extensive monthly reporting requirements and strict cash controls.

Illustrative Lender Collateral

Low Correlation

Idiosyncratic risk drivers and highly diversified portfolios result in asset performance that is typically less correlated to market and macro factors. Taking commercial legal assets as an example, the settlement outcome of a mass tort or IP infringement case is uninfluenced by broader market and economic factors. Furthermore, the settlement outcomes of individual cases within a broader, diversified portfolio are driven by different case-specific factors that are typically uncorrelated to each other.

Key Investment and Structuring Considerations

Underwriting

Underwriting ABSF investments requires comprehensive due diligence of the asset origination platform and of the highly diversified portfolio of assets that serve as collateral to the debt investment.

At the origination platform level, underwriting serves to identify borrowers with scaled, institutional-grade processes across asset origination, asset servicing and risk management. Historical performance is scrutinized to identify platforms that have outperformed industry standards. While diligence may differ by type of platform, underwriting would generally seek to build an investment thesis around:

Track record of asset performance

Portfolio diversification

Broad and differentiated sourcing channels

Disciplined asset selection and risk management processes

Experienced management teams

Asset-level due diligence involves granular, asset-by-asset analysis to assess key performance indicators such as collections, duration and losses. Performance is stratified across a range of variables, including vintage, asset type, channel, geography and payor. Additionally, asset underwriting encompasses stress testing and stochastic modeling to analyze performance distribution scenarios and tail risk. Finally, third-party experts are often engaged to validate asset valuations and quality.

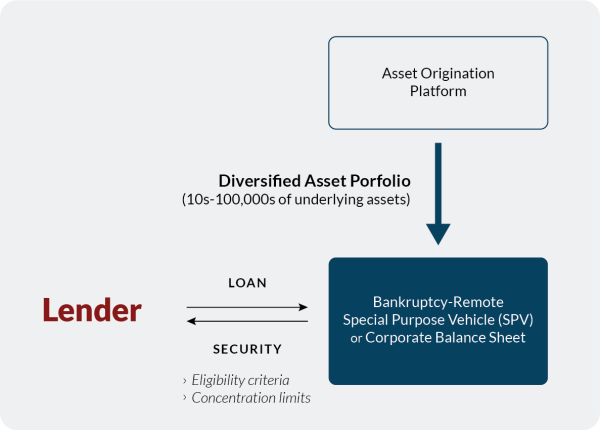

Structuring

ABSF loans may be secured by a corporate balance sheet. However, in many cases, loans are made into a newly created, bankruptcy-remote special purpose vehicle (SPV) that holds the collateral assets and protects them from bankruptcy liability at the borrower/platform level.

Lenders typically enter into a Deposit Account Control Agreement (DACA) with the borrower whereby the lender is granted a security interest in the relevant cash account that gives the lender overarching control over the distribution of funds, in the case of borrower default.

These are important protective features of ABSF loans. Effectively, the bankruptcy-remote SPV structure and cash controls offer the lender the ability to wind down the collateral assets and direct all cash flow to repay the loan, if required. A secondary backup servicer will often be identified at the time of underwriting to help ensure seamless wind-down of assets in the event of underperformance or bankruptcy of the origination platform.

Illustrative Structuring

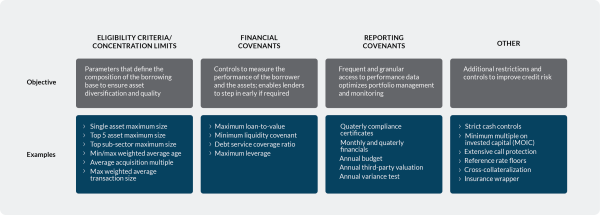

Controls and Documentation

ABSF loans tend to benefit from stringent documentation by providing controls and protections for lenders such: as (i) negotiated eligibility criteria and concentration limits that define the borrowing base and ensure the collateral portfolio achieves desired levels of diversification, and (ii) financial covenants that ensure swift and effective enforcement of security in circumstances of platform or asset underperformance.

In addition, robust reporting covenants ensure frequent and granular performance information is provided to the lender, enabling effective and timely risk management of underlying assets.

These features are individually negotiated on each transaction to ensure that lenders have robust protection, efficient enforcement triggers and access to timely asset performance data.

Illustrative Lender Protections

Conclusion

ABSF's value proposition is driven by well executed underwriting and structuring. In particular, niche ABSF has historically demonstrated low correlation to the broader market and macroeconomic factors. Within a broader private credit portfolio, the addition of ABSF can provide enhanced diversification, elevated yield and strong downside risk mitigation.

ENDNOTES

The Lender Collateral, Lender Protections and other characteristics of ABSF highlighted above are for illustrative purposes only. Accordingly, ABSF deals may exhibit all, some or none of the characteristics highlighted above.

1. Source: Oliver Wyman. Private Credit’s Next Act: Why Private Credit is Tapping into Asset-Based Lending.

Important Notices

This primer is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. All information is current as of the date of this material and is subject to change without notice. Northleaf’s views and opinions expressed herein should not be construed as absolute statements, do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. No representation, express or implied, is given regarding the accuracy of the information contained in this outlook and there can be no assurance that any of the trends highlighted above will continue in the future. Certain of the information in this outlook was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.

These materials may contain forward-looking statements based on experience and expectations about these types of investments. For example, such statements are sometimes indicated by words such as "expects," "believes," "seeks," "may," "intends," "attempts," "will," "should," and similar expressions. Those forward-looking statements are not guarantees of future performance and are subject to many risks, uncertainties and assumptions that are difficult to predict.

Certain examples are provided herein for illustrative purposes and should not be considered a complete discussion of the relevant discussion. Northleaf Capital Partners® and Northleaf® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.