The Benefits and Requirements for Investing in Evergreen Private Credit Funds

Private credit is a $1.2 trillion asset class that has matured and proven its resilience over the past 20 years, performing well through both the GFC and the recent COVID-induced global economic shutdown.

Top-performing private credit funds have rewarded investors with strong and steady returns and cash distributions through periods of market volatility for a number of reasons, including their high-quality, diversified portfolios that boast strong borrower fundamentals and low loss rates.

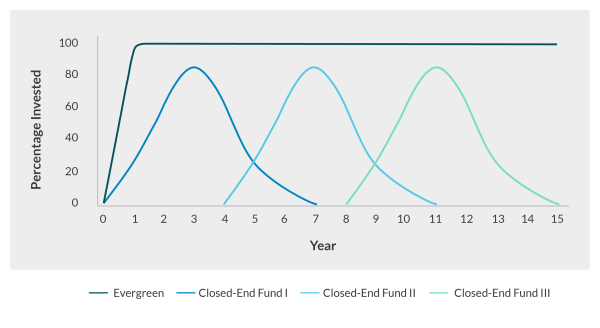

With the higher base rate environment enhancing yield in an asset class characterized by floating rate loans, more and more investors are looking to enter private credit or increase their existing allocations. Those investors now have more options to access the asset class, with evergreen fund structures emerging as an alternative to the closed-end fund structures that have characterized the market to date.

Large asset allocators with advanced operational platforms have long been familiar with managing their investments through closed-end structures, which are common across private markets. Evergreen structures have been developed, in part, to facilitate access for a broader range of investors by addressing the allocation management and administrative requirements faced by some institutional investors when first entering the asset class, including multi-employer pension plans, endowments and family offices. However, the attributes of evergreen structures can be appealing to a broad range of private credit investors.

Benefits of evergreen structures

Evergreen structures can offer many benefits to private credit investors, including:

- Immediate exposure to a well-diversified portfolio of private credit investments;

- Consistent quarterly cash yield;

- A more defined and shorter drawdown schedule, ensuring capital is put to work quickly and efficiently, and reducing the administrative burden of managing ad-hoc capital call requirements;

- Recycling of principal, providing the ability to maintain exposure to the strategy and asset class without ongoing re-ups; and

- Enhanced liquidity options and quarterly ‘openings’, providing investors with the opportunity to rebalance allocations and exposures over time.

Key success factors investors should look for

Several factors underpin the successful management of evergreen private credit structures and should be considered by investors in evaluating fund offerings.

- Appropriate liquidity provisions: The fund’s liquidity provisions should be driven by, and aligned with, the strategy of the fund and the natural liquidity of the underlying assets. Private credit benefits from natural liquidity through the dynamic refinancing, maturation and amortization of loans, typically over a three-to-four-year time horizon. As a result, investor liquidity can be aligned with loan liquidity in a thoughtfully designed and well-managed evergreen fund structure, ensuring that investors enjoy enhanced liquidity options without compromising the intrinsic benefits of private credit exposure.

- “Pure-play” benefits: Investors who wish to capture the full premium offered by private markets investments and are able to accept a degree of short-term illiquidity should seek pure-play private credit exposure within the portfolio. Some evergreen funds offer a mix of exposures across private and public fixed income, which dilutes that premium for investors who do not need the short-term liquidity.

- Origination and diversification: Strong origination capabilities and a well-diversified, high-quality pipeline are particularly important to the effective construction and management of an evergreen private credit portfolio. Consistent access to a broad range of on-strategy opportunities is necessary to deliver stable returns, reduce risk concentration through diversification and support investor liquidity requirements without compromising asset quality.

- Robust portfolio risk management: Effective management of a large portfolio and a fund structure with ongoing capital flows requires a focused, sophisticated approach to portfolio management and fund oversight to ensure that investment correlation, fund liquidity and operational risks are all properly managed. These considerations are far more important in evergreen structures than in traditional closed-end vehicles.

With these key success factors in place, open-end evergreen funds can provide investors a powerful option to access the private credit opportunity.