PIAC Communiqué: Private Equity Market Sees Resilience and Opportunity in Face of COVID-19

lmpact of the pandemic on private equity to date

The pandemic’s impact on the private equity market has manifested itself in a number of distinct ways. In the early days of COVID-19, private equity’s response was defensive in nature. Private equity firms shifted their focus almost entirely towards their existing portfolios and the liquidity needs of their portfolio companies. This “triage” approach made good sense, as the early days brought significant uncertainty and portfolio company revenues were impacted by the unfolding crisis, in some cases severely. However, it quickly became apparent that liquidity in the private equity market was not a major concern for most companies. Private equity managers’ active involvement in their portfolios, combined with access to committed pools of capital, allowed them to react quickly and support companies in need of temporary capital, helping to weather the storm and prepare for the road to recovery.

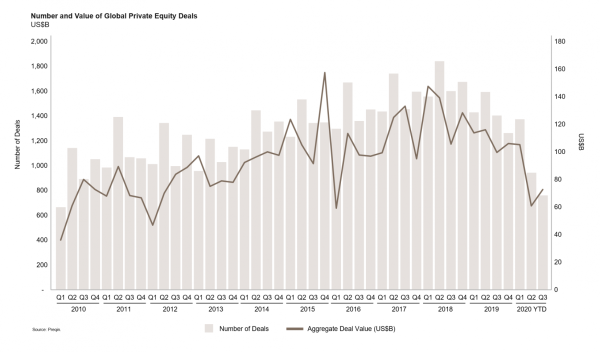

New platform and add-on M&A deal volumes slowed dramatically through Q3 as many buyers and sellers pulled back on M&A processes and focused resources internally. Refer to Figure 1 for global private equity deal volumes by quarter for the past decade. Sale processes that were not well advanced were, for the most part, put on hold due to the uncertainty of revenue and EBITDA performance. Debt markets also retrenched, which decreased access to leverage, increased borrowing costs and led to more stringent covenant demands for any new investment opportunities. Transactions that did close were those that were well advanced prior to March or where COVID had limited to no impact on earnings.

The slowdown of new platform deals has in turn impacted the primary fundraising market. With fewer transactions closing, many private equity managers have delayed the launch of their subsequent funds. For those managers that are moving forward with fundraising, it is becoming more binary with top-performing funds being able to move quickly to commitments while second-tier managers are seeing a delayed decision process from investors that are shifting priorities.

The uncertainty has also impacted the secondary market. Deal volumes for limited partner and GP-led secondaries slowed dramatically due to valuation uncertainty. The current market environment is likely to result in increased hold periods for private equity assets as certain investments will take more time to recover. This is likely to result in an increased volume of GP-led “continuation vehicle” transactions for both whole funds or single assets. Continuation vehicles are increasing in popularity because they provide limited partners with an option to sell their investment or roll into a new SPV while providing private equity managers with refreshed timelines, additional capital and alignment for assets with which they are familiar. As Q2 valuations appear to have broadly stabilized, Northleaf anticipates secondary deal volumes to rise through the second half of 2020 and into 2021.

Structural benefits of private equity

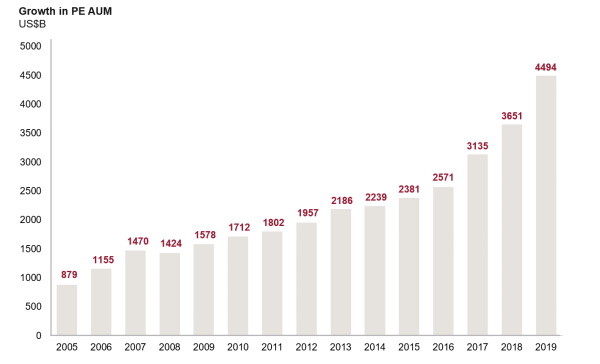

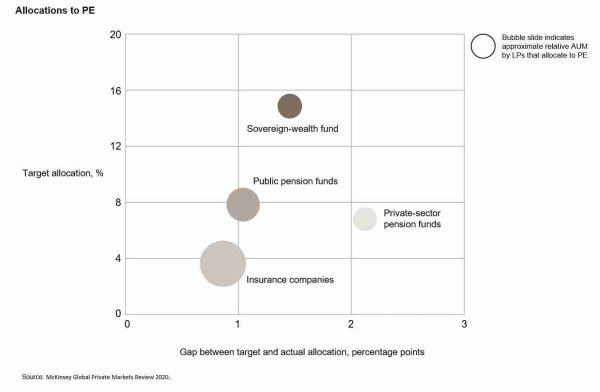

The private equity industry entered the current market environment from a position of relative strength, driven by a number of key structural factors. There is a broader trend globally among institutional and high net worth investors toward increased private markets allocations. Refer to Figure 2 for growth in private equity AUM over the past decade. In the same time period, pension investors in Canada have steadily increased their allocations to private equity, growing from ~7% of plan assets in 2010 to just over 12% at the end of 20191, as these institutions have recognized the benefits of private equity. This growth is not expected to abate as many investors remain under-allocated to the sector versus target levels, as shown in Figure 3. While COVID has slowed the pace of commitments and deployment for some investors, many have remained active with a view to participating in an anticipated opportunity arising out of the current environment, and the demand for the asset class is expected to remain strong.

Core to the private equity asset class is that investors typically commit to long-term investments, trading off liquidity in the public markets for less volatility and the expectation of higher returns over time. This long-term horizon provides investors with the ability to be patient without significant pressure to invest or exit in uncertain market environments. This was evident through Q2 as both new investments and exits within private equity primary, secondary and co-investments slowed significantly due to uncertainty in the markets. Despite the uncertainty, private equity investors were able to remain patient and focus on supporting the performance of their portfolios.

Even before the pandemic became daily front-page news, private equity investors had been preparing for a market correction. Many have been focused on high-quality, cyclically-resilient companies which should deliver more resilient performance despite the challenging economic and business environment. In addition, the active management role that private equity firms take in the management of their underlying portfolio companies, working closely with management teams and establishing in-house portfolio operations expertise, has proven to be valuable in helping weather uncertainty in prior downturns and through the current market environment as well.

These attributes of the private equity industry provide resilience to the sector. As a result, while valuations of most private equity portfolios declined in Q1, the impact was significantly more muted than that seen in the public markets. For example, the Cambridge Associates Private Equity Index, which represents the collective results of over 2,000 private equity funds globally, declined by 8.9% in U.S. dollar terms over Q1 whereas the MSCI World Index saw a drop of 20.9%, also in U.S. dollar terms. Similar to the public markets, early indications for Q2 private equity valuations are showing a rebound in value.

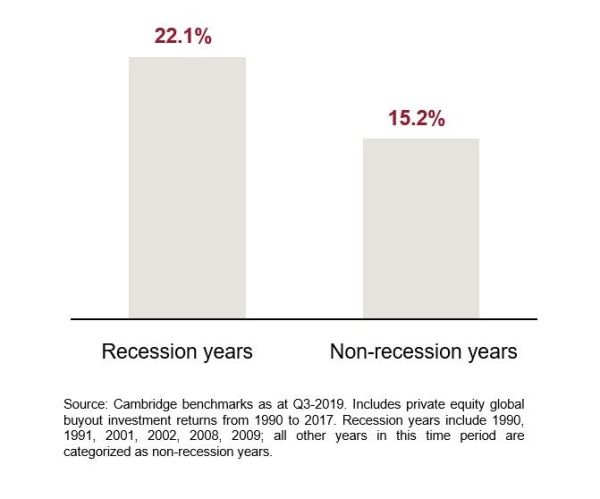

These structural elements also position private equity well to generate returns going forward. The levels of dry powder available in the market, estimated to be approximately $2.3 trillion in H1 20192, mean that private equity managers have access to capital, providing the ability to move quickly in periods of dislocation. Historically, private equity funds have delivered strong returns during such periods, as shown in Figure 4. We believe that as the current crisis continues to unfold, over time the private markets could generate similar outperformance as seen in prior downturns, driven by more attractive purchase valuations that can result from market uncertainty.

Emerging with Momentum

While private equity has not been unscathed by the impact of COVID-19, it is expected to remain an attractive asset class given the size and breadth of investment opportunities anticipated to materialize as the world recovers from the pandemic-induced downturn.

As governments around the world have taken steps towards re-opening their economies, private equity firms are increasingly turning their attention to “offence,” and actively identifying and pursuing new opportunities. Firms are focused on businesses positioned for sustainable long-term growth, value-added asset management initiatives and secondary market transactions offering advantageous pricing and strong risk-adjusted returns.

Private equity investors should continue to view their private markets strategies with a long-term perspective. There are clear benefits to a private equity strategy focused on creating diversified exposure to private company value creation. The strong alignment across investor, private equity manager and company management has been clearly demonstrated in this most recent period. The pandemic has shown that diversified allocations to private markets provides investors with less volatility in uncertain markets while also allowing for access to compelling investment opportunities with the potential to deliver strong risk-adjusted returns.

1. Source: Pension Investment Association of Canada Asset Mix Report.

2. Source: McKinsey Global Private Markets Review 2020.