Private Credit Market Update: Q4-2025

Q4-2025 Market Update

The fourth quarter closed the year against a more stable economic outlook relative to the first half of 2025. Although tariff policies continued to have an impact on certain segments of the economy and market volatility persisted, overall economic growth proved resilient in the latter part of the year, helping to bolster investor confidence heading into 2026. However, recovery and performance remain divergent, with certain segments of the economy facing more challenging conditions and weaker consumer sentiment and demand.

During the quarter, the U.S. Federal Reserve continued its rate-easing cycle, implementing two 25 basis point cuts and bringing three-month SOFR to 3.7% at the end of the fourth quarter — the lowest level in three years, though still above long-term averages. The combination of a lower cost of capital and a more stable economic outlook supported a positive shift in investor sentiment, which contributed to renewed momentum in M&A and LBO activity in the second half of 2025, a trend we expect to continue into 2026.

Against this backdrop, several key trends shaped the private credit market in Q4 2025:

Easing base rates and stabilized but tightened credit spreads.

Improving momentum in deal volume, though the recovery in LBO/M&A activity has been gradual.

Stronger relative value across core mid-market direct lending, Europe and asset-based specialty finance.

Continued sector bifurcation with higher expected losses in select sub-segments, including consumer and healthcare services, though overall borrower performance remains relatively resilient.

Easing base rates and stabilized but tightened credit spreads.

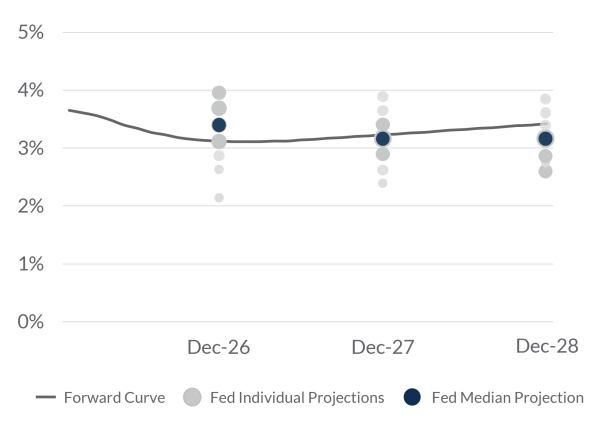

Private credit yields remain attractive, generating high single-digit unlevered gross returns despite the decline in base rates and spread compression (see Figure 1). The Federal Reserve’s two rate cuts in the fourth quarter brought the total number of cuts in 2025 to three, reinforcing expectations of a lower rate environment. At the same time, the Fed signalled a more measured pace of easing in 2026. This guidance contributed to a modestly more hawkish forward curve, with current projections implying an average base rate of ~3.3% over the 2026 to 2028 period (see Figure 2), approximately 15 basis points higher than expectations last quarter.

Figure 1: Gross Asset Yield on New Senior Secured Loans

Unlevered (USD)

Figure 2: Projected US Base Rates

January 2026 to December 2028

Base rate: 3M SOFR as of end of period (December 31, 2025). Fee-adjusted spread: Cliffwater LLC. All Rights Reserved. Reproduced with permission. Sponsored Direct Lending New Issue 1L All-in Yields. Fee-adjusted spread represents spread and 3-year amortized OID figures averaged over 2024 and 2025. There can be no guarantee of future performance.

Source: Chatham Financial. 3-month SOFR forward curve as of January 7, 2026, and Fed projections as of December 10, 2025. There can be no assurance that any of these projections will be validated by actual events.

Credit spreads remain tight but continue to offer an attractive premium relative to public credit markets (see Figure 3). This spread differential reinforces the appeal of private credit for investors seeking enhanced yield, contractual cash flows, and downside protection. Looking ahead, a sustained increase in deal activity should help further support stabilization, or a potential modest widening, in credit spreads.

Figure 3: Private Credit Provides an Attractive Return Premium

Direct Lending Source: Cliffwater LLC. All Rights Reserved. Reproduced with permission. Broadly Syndicated Loans and High Yield Source: Pitchbook. Data through December 31, 2025. Quarterly figures calculated as a 3-month average.

Improving momentum in deal volume, though the recovery in LBO/M&A activity has been gradual.

Deal flow in the second half of 2025 benefitted from easing interest rates, improving sponsor and lender confidence, and the deployment of more private equity dry powder. Expectations for a more pronounced rebound earlier in the year were tempered by global economic volatility and policy-driven uncertainty, causing investors to remain cautious and selective. As valuation expectations between buyers and sellers converge alongside more attractive financing conditions, greater momentum is showing in M&A/LBO activity heading into 2026 (see Figure 4 and Figure 5). This aligns with sponsor expectations, with two-thirds of dealmakers expecting higher transaction volumes in 20261.

Figure 4: Momentum in M&A/LBO Volumes

Figure 5: Momentum in M&A/LBO Volumes

Source: Pitchbook/LCD. Data through December 31, 2025. US direct lending estimated volumes, LBOs.

Source: Pitchbook/LCD. Data through December 31, 2025. Europe direct lending estimated volumes, LBOs.

Stronger relative value across core mid-market direct lending, Europe and asset-based specialty finance2.

The core mid-market (EBITDA of US$20 million to US$80 million) continues to offer stronger risk-adjusted returns. This segment typically benefits from more conservative deal structures, including maintenance covenants, prudent leverage levels, and meaningful equity cushions, which collectively provide strong downside management. By contrast, increasing convergence between the upper mid-market and the broadly syndicated loan market has intensified competition to finance larger businesses, resulting in tighter spreads and weak lender protections within that segment.

In Europe, attractive pricing and structures have been supported by a more fragmented financing ecosystem, demand for bespoke and multi-currency solutions, and a relatively limited supply of private credit capital. Asset-based specialty finance also remains compelling, offering strong collateral coverage, lower correlation with traditional corporate credit, and robust downside protection.

Continued sector bifurcation with higher expected losses in select sub-segments, including consumer and healthcare services, though overall borrower performance remains resilient.

While the second half of 2025 saw several high-profile corporate bankruptcies (for example, First Brands Group and Tricolor Holdings), these events were largely idiosyncratic and mostly concentrated in typically non-sponsored, more cyclical sectors. In our view, they have not signalled broader systemic stress within the private credit market. Rather, they highlight the importance of partnering with experienced managers that employ disciplined underwriting, rigorous portfolio monitoring, and strong governance frameworks. Alignment with high-quality private equity sponsors remains critical, with a focus on partners who are supportive of constructive lender relationships, transparency, and accountability.

Overall borrower performance across the market has remained resilient, with default rates broadly in line with long-term averages. That said, we are observing increased pressure in select sectors, most notably healthcare services and certain consumer-facing industries, contributing to an uptick in market loss rates. Within healthcare—particularly physician practice management—long-term demand drivers remain constructive, though higher labor costs and constrained labor availability have placed short-term pressure on margins and cash flows. In the consumer segment, some borrowers are beginning to feel the effects of softer consumer spending. By contrast, we continue to see stronger performance and deal flow in commercial and professional services, diversified financials, and software and services.

Private credit continues to demonstrate resilience across market cycles, offering investors attractive risk-adjusted returns and consistent contractual cash yield. Mid-market private credit has historically delivered lower loss rates relative to leveraged loans and high-yield bonds, supported by conservative structures and strong lender protections. As market conditions stabilize and the opportunity set expands, we believe the asset class remains well positioned to deliver compelling outcomes for investors.

Endnotes:

Unless otherwise indicated, all NSPC figures and metrics are in USD and as at December 31, 2025.

Cliffwater,” “Cliffwater Direct Lending Index,” and “CDLI” are trademarks of Cliffwater LLC. The Cliffwater Direct Lending Indexes (the “Indexes”) and all information on the performance or characteristics thereof (“Index Data”) are owned exclusively by Cliffwater LLC, and are referenced herein under license. Neither Cliffwater nor any of its affiliates sponsor or endorse, or are affiliated with or otherwise connected to, Northleaf Capital Partners, or any of its products or services. All Index Data is provided for informational purposes only, on an “as available” basis, without any warranty of any kind, whether express or implied. Cliffwater and its affiliates do not accept any liability whatsoever for any errors or omissions in the Indexes or Index Data, or arising from any use of the Indexes or Index Data, and no third party may rely on any Indexes or Index Data referenced in this report. No further distribution of Index Data is permitted without the express written consent of Cliffwater. Any reference to or use of the Index or Index Data is subject to the further notices and disclaimers set forth from time to time on Cliffwater’s website at https://www.cliffwaterdirectlendingindex.com/disclosures.

- KPMG 2025 Year-End M&A Study. As of December 2025.

- The characteristics of mid-market deals, including asset-based specialty finance, are provided for illustrative purposes only. Notwithstanding the risk control mitigants highlighted, any investment is subject to risk of loss.

Important Notices:

This document is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. The views and opinions expressed herein do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. There can be no assurance that any of the trends highlighted above will continue in the future, Certain of the information set forth herein was gathered from various third-party sources which Northleaf believes to be accurate, but has not been able to independently verify.

This document has been prepared solely for information purposes by Northleaf, and by accessing it, you hereby agree that it is being made available on the express understanding that it will not be reproduced by you to third parties without Northleaf’s prior written consent.

Northleaf Capital Partners® and Northleaf ® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.