Private Equity Market Update: Q4-2024

Private equity continues to demonstrate resilient fundamentals amid macroeconomic uncertainty. 2025 will require balancing optimism with agility to navigate shifting market dynamics and capitalize on attractive investment opportunities.

After a measured pace in 2024, investor appetite is expected to strengthen in 2025, reinforcing the role of private equity as a key driver of diversified, differentiated returns through active value creation and its ability to adapt across market cycles.

Key Observations

Private equity is gaining momentum as deal and exit activity accelerate, driving renewed growth in private capital.

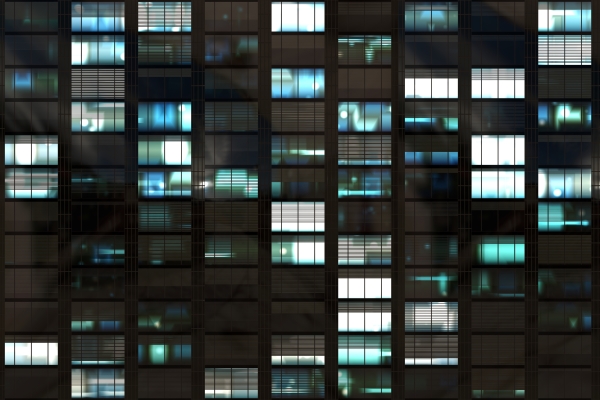

Private equity deal activity rebounded in 2024 and is expected to increase further in 2025 as lower borrowing costs support valuations and GPs seek to deploy capital raised from 2022 to 2024 vintages. In 2024, deal values increased by 18% while deal count declined by 5% as value was driven by fewer larger deals. In 2025, we expect volumes to rise due to significant levels of dry powder that need to be deployed and narrowing bid-ask spreads.

Global Private Equity Deal Activity1

US$ Billion

Near record levels of private equity dry powder (over $1 trillion in the US alone) highlight the industry’s need for more rapid capital deployment and position GPs to accelerate the pace of deal-making in 2025. Although private capital fundraising activity has declined from its 2021 peak, the buildup of dry powder in the system will take firms years to work through.

Despite near-term trade uncertainty, exit activity in 2025 is poised to gain momentum. We expect more PE-backed companies to come to market in 2025 stemming from a combination of postponed processes and an improving macroeconomic environment. However, certain sector components of the M&A market may be impacted by the ongoing tariff situation, potentially affecting deal flow and exit timing.

While macroeconomic and trade uncertainty loom, we have not yet witnessed significant disruption to M&A markets. Mid-market private equity is expected to be relatively well-positioned amid broader economic risks, though not entirely immune to the potential impact of a tariff war.

The global economic outlook and capital markets conditions will be influenced by key decisions made under the US tariff policy. With the recent announcement of new US tariffs. Investors generally will be more attuned to the underlying sector exposures in their portfolios. The regional and national focus of mid-market companies helps mitigate—though not eliminate—exposure to global supply chain disruptions and cross-border trade challenges. Additionally, the sector's tilt toward services rather than heavily trade-dependent industries provides a degree of insulation. Private equity’s governance model and level of capitalization also provide advantages that can help PE-backed companies in traditionally resilient industries sustain strong performance. Interest rate cuts are expected to be more gradual in the US than initially anticipated, maintaining a “higher-for-longer” environment that will influence capital deployment, valuations, and exit strategies.

Capital calls are anticipated to outpace distributions, adding pressure on investors who have yet to see a meaningful rebound in distributions.

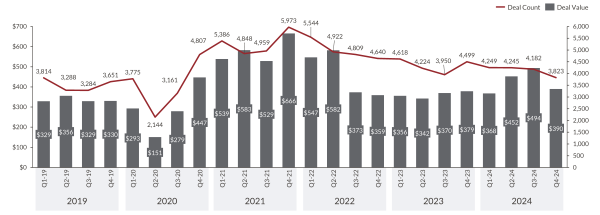

As deal activity and the M&A market pick up, GPs will likely start to call more capital from their investors; however, distributions may be slower to materialize. Many investors may find themselves in the same negative cash position they have faced for the past five years. This dynamic bodes well for the secondary market which achieved a record $160 billion transaction volume in 2024. The key drivers of LP-led transaction volumes were portfolio management, liquidity needs, and downside exposure management. GP-led transaction volumes saw significant increases as GPs continued to find ways to back their top-performing portfolio companies.

Secondary Volume by Type4

US$ Billion

As illustrated below, LP portfolio sales accounted for >50% of the secondary transaction volume in 2024. Single-asset continuation funds saw a moderate increase to 19%, up from 16% in 2023.

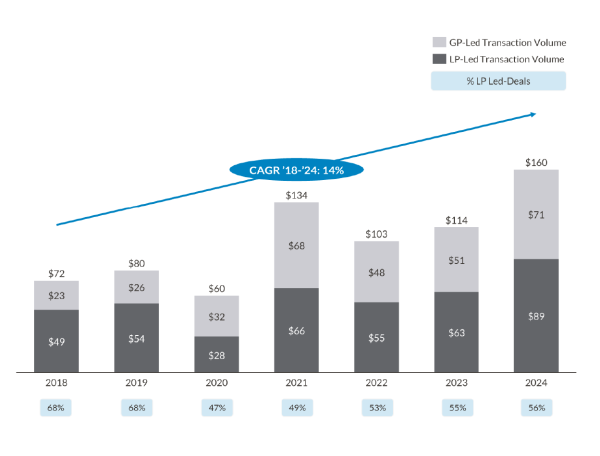

Secondary Volume by Transaction Type5

Pricing for LP-led secondaries was strong in 2024, rising from 91% to 94% of NAV for buyout funds and up from 85% to 89% for all fund types. Venture saw the most notable increase from 68% to 75%.

LP Portfolio Pricing Summary (% of NAV)6

Overall, the market opportunity is highly attractive for private equity, reinforcing the role of private equity as a key driver of diversified, differentiated returns through active value creation and its ability to adapt across market cycles.

Endotes:

Global Private Equity Deal Activity Source: Pitchbook Global Private Equity Deal Activity, January 2025.

Private Equity Dry Powder Source: Preqin, as of December 31, 2024

Secondary Market Source: Evercore, Secondary Market Update, January 2025.

Secondary Market Source: Evercore, Secondary Market Update, January 2025.

LP Portfolio Sales Source: Evercore, Secondary Market Update, January 2025.

LP Secondary Pricing Source: Jefferies, Secondary Market Update, January 2025. All represents Buyout, Venture / Growth, Credit and Real Estate.

Important Notices:

This document is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. The views and opinions expressed herein do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. There can be no assurance that any of the trends highlighted above will continue in the future, Certain of the information set forth herein was gathered from various third-party sources which Northleaf believes to be accurate, but has not been able to independently verify.