Private Equity Market Update: Q4-2025

We continue to view private equity as a core driver of long-term returns and portfolio diversification. While the global macro environment remains highly uncertain, we believe the structural advantages inherent in private equity ownership and the value creation capabilities that top PE managers have developed, may offer durable sources of outperformance. We believe there continues to be an opportunity set within the secondaries market as current deployment dynamics offer the ability for attractive risk-adjusted return potential.

We observed the following trends in the private equity market during the fourth quarter of 2025:

An operationally driven playbook remains a primary source of alpha in mid-market private equity which delivers resilience during periods of disruption

As 2026 gets underway, AI-driven advancements appear to have accelerated faster than market expectations. While AI’s potential to disrupt will vary by industry and business model, high quality private equity managers are increasingly making AI an integral consideration in sourcing, due diligence and value creation plans. In light of recent advances, we expect high quality mid-market managers to continue to evolve their value creation playbooks to systematically improve portfolio companies with an aim towards making them more resilient during periods of disruption.

The mid-market private equity segment’s typical structural advantages — including lower entry valuations and reduced reliance on leverage — enable returns driven by EBITDA growth rather than financial engineering.1 Active ownership and hands-on governance further position mid-market sponsors to respond decisively to change, enabling swift strategic and operational improvements at the portfolio company level.

What began as a relief valve during periods of dislocation has evolved into the secondary market serving as a core portfolio construction tool within private markets

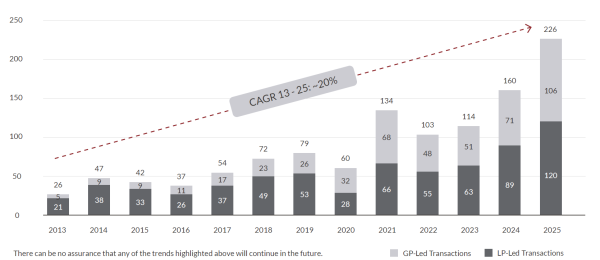

We remain particularly constructive on the opportunity set within the secondaries market, where we continue to see attractive dynamics and the potential for compelling risk-adjusted return. The secondary market crossed a meaningful milestone in 2025, closing the year at a record $226 billion in transaction volume. What was once used episodically has now become embedded in institutional portfolio construction and liquidity management. Over the past decade, this has translated into ~20% annualized growth, underscoring the structural expansion of the secondary market since 2013 (see Figure 1).

LP-led secondaries remain more than 50% of the secondary transaction volume.2 Notably, 60% of LP sellers were repeat participants, signaling normalization and growing institutional comfort with secondary execution.3 LP-led secondaries continue to offer the ability to access to well-diversified, seasoned portfolios with embedded growth potential and attractive entry pricing.

GP-led deal volume soared to $106 billion in 2025, a 49% increase from $71 billion in 2024 (see Figure 1). Continuation vehicles have become a mainstay, now accounting for 14% of all sponsor-backed exits (up from 13% in 2024).4 The average CV size grew by 18%, and the number of $1+ billion CVs rose by more than 50% year-over-year, reflecting both the scale and acceptance of these structures.4

Figure 1: Secondary Market Transaction Volume5

(US $billion)

A target-rich but capital-constrained market favours disciplined mid-market secondary buyers

The capital overhang multiple—dry powder relative to transaction volumes stand at 1.2x,6 materially below the five-year average of 1.9x and well below the buyout market’s 2.6x.7

A lower overhang indicates a market in which capital is scarce relative to the volume of assets seeking liquidity. For disciplined investors, this imbalance can create more favorable entry pricing, reduced competitive intensity, greater selectivity and negotiating leverage, and the ability to focus on higherquality assets without stretching for deployment.

Taken together, this capital-supply imbalance represents a durable structural tailwind that supports attractive vintage-year return potential. With more than 60% of Private Equity NAV concentrated in mid-market funds, the opportunity for mid-market secondaries is currently both structurally supported and deep,8 which should offer attractive vintage-year return potential for those able to deploy capital with discipline.

Against this backdrop, a target-rich but capital-constrained environment continues to advantage experienced mid-market secondary buyers. Selectivity, underwriting discipline, access to quality mid-market deal flow and an operationally oriented value creation playbook remain key differentiators in capturing attractive risk-adjusted private equity returns in the current cycle.

Endnotes:

- Mid-market NAV Source: Preqin; Global PE NAV includes North American and European buyout and growth NAV as of June 30, 2025. Large and Mega defined as fund size of $5B+. Mid-market defined as fund sizes <$5B.

- LP-led Secondary Market Share Source: Jefferies, Global Secondary Market Review, January 2026.

- Secondary Market Participants Source: Jefferies, Global Secondary Market Review, January 2026.

- CV Deal Size Source: Jefferies, Global Secondary Market Review, January 2026.

- Historical Secondary Market Deal Flow: Evercore, 2025 Secondary Market Highlights, January 2026.

- Capital Overhang Multiple Source: Evercore, 2025 Secondary Market Highlights, January 2026.

- Historic Average Capital Overhang Multiple Source: Jefferies, Global Secondary Market Review, January 2026.

- Mid-market NAV Source: Preqin; Global PE NAV includes North American and European buyout and growth NAV as of June 30, 2025. Large and Mega defined as fund size of $5B+. Mid-market defined as fund sizes <$5B.

Important Notices:

This document is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. The views and opinions expressed herein do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. There can be no assurance that any of the trends highlighted above will continue in the future, Certain of the information set forth herein was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.