Asset-Based Specialty Finance Spotlight: Lending Against Music Royalty Assets

Music Royalty Assets

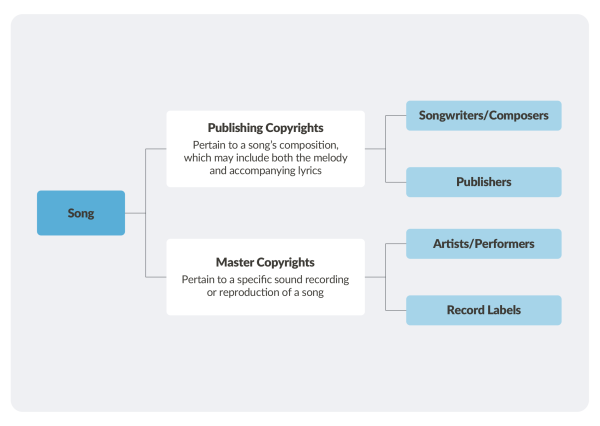

Like other forms of asset-based investing, music royalty investments are underpinned by an asset: music copyrights. Royalties are typically generated every time a song or composition is streamed, downloaded, performed or placed in film, TV or other audio-visual mediums. Different forms of copyrights (and their respective owners) are entitled to different forms of royalty income.

The market for music monetization continues to grow. For artists, composers or other copyright owners, the opportunity to monetize long-lived assets and place them with sophisticated custodians can be a highly attractive proposition. Selling a copyright to a music rights platform (“Platform”) enables a copyright owner to crystallize future royalty cash flows and generate immediate liquidity. Platforms increasingly raise dedicated capital to aggregate portfolios of music intellectual property (“IP”). These Platforms create value by building scale, diversification and growing underlying royalty streams of music portfolios through active management.

Partnering with a Platform and lending against a portfolio of music copyrights can represent a compelling value proposition for private credit investors. Royalty income can offer stable cash yield while lending structures typically reflect conservative loan-to-values and wide-ranging financial and asset covenants to manage downside risk.

Unlocking Value through Debt-Focused, Niche Asset-Based Specialty Finance

Asset-based specialty finance (“ABSF”) sits in a unique part of the private credit landscape from a risk/return perspective. While the return profile can often align with opportunistic or distressed strategies, ABSF is typically collateralized by portfolios of performing assets, consistent with traditional lending. The market is commonly segmented into: (1) consumer, (2) commercial and (3) niche asset categories. Each of these segments offer investors unique and diversified exposure with varying return, correlation and risk characteristics.

A debt-oriented focus on niche assets represents a particularly interesting intersection within the ABSF opportunity set, with well-structured investments offering the potential for enhanced yield, diversified collateral coverage and lender protections. Underwriting is granular and specialized while borrowers often seek bespoke and customized structures. This creates natural barriers to entry for traditional capital providers such as banks and generalist pools of institutional capital.

Music Royalty Types

Music monetization is anchored on the foundation of two types of copyrights: publishing and master. These copyrights are historically controlled by songwriters/composers and artists/performers and separately represented by publishers and record labels. Each of these groups benefits from a share of the cashflow generated from the copyright. As an example, the melody and accompanying lyrics of a classic song, “Tennessee Whisky,” was composed by Dean Dillon and Linda Hargrove who would have originally held the publishing copyrights. Over the years, many artists have made individual and creative recordings (e.g., Chris Stapleton, George Jones) with associated master copyrights.

The two types of copyrights generate revenue through three main royalty streams:

Mechanical Royalties

Earned from the sale of the song or recording, whether physical (such as CDs or vinyl) or digital (such as downloads or streaming)

Performance Royalties

Earned through live public performances or when a song is streamed in public venues like restaurants, bars, gyms, live concerts or through programmed music services

Sync Royalties

Earned from licensing songs, compositions or recordings for use as embedded music in movies, TV shows or commercials

Industry Overview

Today, music is more accessible than ever, driven by the proliferation of streaming services such as Spotify, Amazon Music and Apple Music. Music is also expanding beyond traditional platforms and now seamlessly integrates across channels such as gaming, home fitness and social media.

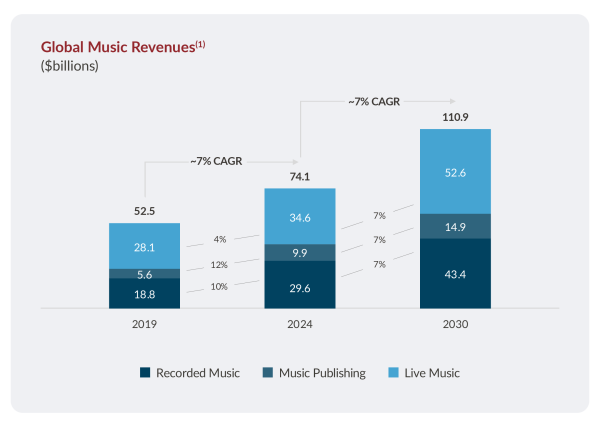

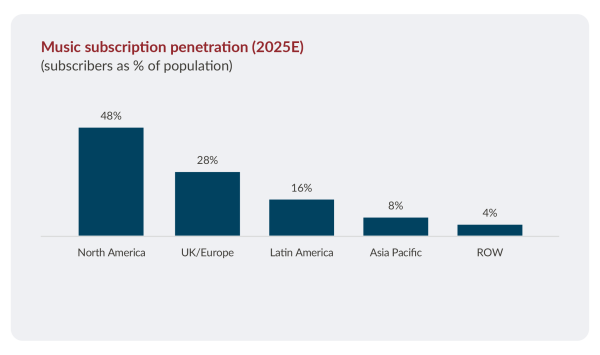

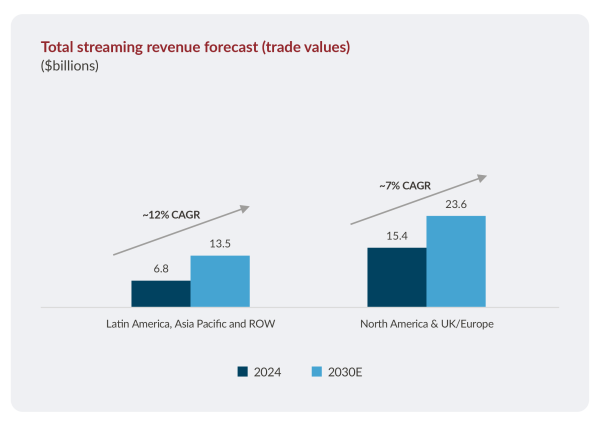

The global music market encompassing publishing, recorded music and live music, is estimated to be ~$74 billion.1 Outsized industry growth over the past five years was primarily driven by higher levels of streaming adoption worldwide. Growth in publishing and recorded music is expected to moderate from the levels seen in 2019–2024, though still projected to remain at ~7% per annum through 2030.1 As streaming penetration matures in North America, UK and Europe, drivers of industry growth will likely transition to higher subscription pricing, accelerated streaming penetration in emerging music markets (Latin America, Asia Pacific and ROW) and expansion of music licensing opportunities beyond traditional channels.

Note: Live music revenue comprises ticket and merchandise sales as well as performance royalties.

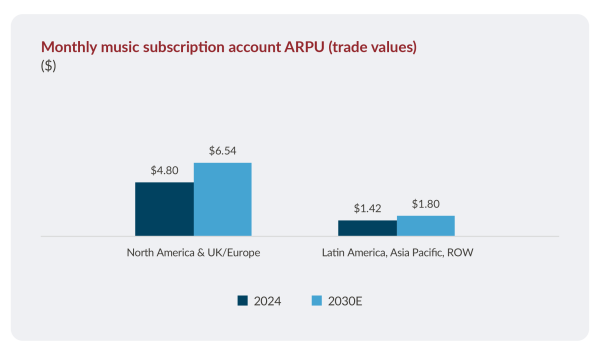

Music revenue growth will be driven by increased streaming penetration in Latin America, Asia Pacific and ROW, coupled with higher monthly average revenue per user (“ARPU”) in North America and UK/Europe as streaming platforms begin raising prices in mature markets(2)

The music industry benefits from a supportive regulatory environment committed to enhancing music content rights for artists and copyright owners. One of the most notable regulatory enhancements in the U.S. was the 2018 Music Modernization Act (“MMA”), which streamlined the licensing and royalty collection process for digital music platforms. Other regulatory enhancements include the 2022 Copyright Royalty Board (“CRB”) adjustment to mechanical royalty rates for streaming and digital sales, which led to rate increases of 44% and 32% in each category, respectively.

Debt Structuring Considerations

The music industry tends to be underserved by traditional financing sources due to the granular and customized nature of underwriting and structuring investments underpinned by music copyrights. This presents an opportunity for private credit lenders to fill the gap, generating attractive returns for well-structured risk.

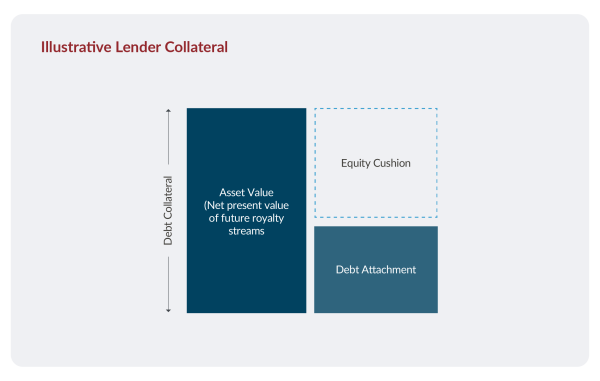

Lenders typically attach at attractive loan-to-values against the overall valuation of the music assets. A lender’s collateral pool also benefits from high levels of diversification in the context of a scaled portfolio with thousands of songs and hundreds of artists across a range of vintages, genres and countries.

Music Asset Maturity and Quality

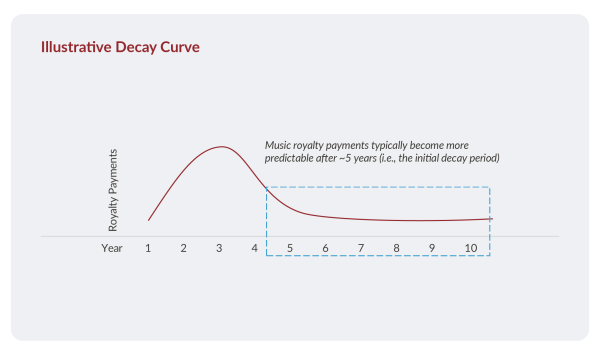

Royalty income from an individual song typically follows a curve, peaking in the first few years after release, declining over the next two to three years, and then stabilizing after roughly five to seven years (absent a resurgence in popularity, which may be driven by specific factors, notably social media virality). Seasoned catalogs of established content benefit from predictable and stable consumption patterns. A key advantage of seasoned content is extensive historical data, enabling meticulous, song-by-song decay curve modeling and rigorous statistical analysis. Conversely, newer songs and current “hits” will likely not have as robust historical data but can present exciting opportunities for outsized growth. Revenue streams, originating from a diverse portfolio of content spanning songs, artists, genres and vintages, and disseminated through multiple delivery channels, can provide investors with stable and resilient income.

Valuation

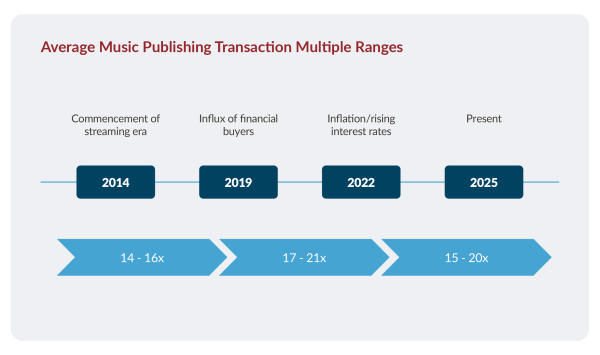

Music valuation multiples are influenced by fundamental factors including portfolio scale, diversification, content maturity and growth, as well as prevailing supply/demand dynamics for these assets. Given the long duration of music assets and bond-like cash flow features, valuations may be more sensitive to interest rates as compared to shorter duration assets. In addition, investment appetite from financial buyers has led to more competition in recent years, particularly for large, diversified and iconic catalogues. These continue to trade at consistently attractive multiples. Platforms that are disciplined in seeking quality, under-monetized assets with a view to build scale and diversification, are better positioned to achieve value creation over the long term.

Source: Shot Tower Capital, S&P Capital IQ, Northleaf estimates

Music Platform Considerations

- Platforms connected with artists, publishers, record labels and other copyright owners can benefit from exclusive or proprietary sourcing relationships.

- A granular, data-driven approach to asset underwriting can more accurately predict the shape of royalty income. For example, analyzing song and artist performance over time, genre trends, royalty structures, channel penetration and other fundamental drivers of asset performance. Conducting look-back analyses to determine the accuracy of the initial forecast enables the Platform to refine model assumptions and better informs future investment appetite.

- Effective asset management focuses on maximizing the value of a music catalog. Strategic initiatives to maximize value may include placing content in films or TV shows (synchronization), establishing new licensing arrangements and collaborating early with songwriters and artists. These efforts may not only increase the catalog’s value but also expand its reach and influence.

Lender Protections

- Asset covenants, including strict eligibility criteria and concentration limits, place guardrails around the collateral pool, ensuring music portfolios are well diversified and exhibit characteristics that meet predefined parameters. For example, restrictions on single song and single artist concentration, minimum age of song, minimum streams per song, exclusion of certain genres, etc.

- Financial covenants may include a subset of maximum leverage, minimum liquidity and debt service coverage, among others.

- Frequent and customized reporting allows for active monitoring of asset performance and covenants.

Potential Risks of Music Royalty Assets

Copyright infringement and reversion have gained prominence, particularly through high-profile cases involving artists and copyright holders. Ensuring a chain of title across prior owners, securing indemnifications where applicable and retaining full control and administrative rights across the publisher’s, writer’s, artist’s and label’s share of royalties are potential ways to mitigate this risk.

The impact of Artificial Intelligence (“AI”) on music content creation, production and licensing is an emerging consideration. There is a heightened focus on managing the risk of infringement and imitation and regulating use of AI-generated content to protect copyright owners. Digital service providers are actively implementing fraud detection technology and expanding teams focused on monitoring and screening songs uploaded from AI imitations.

The risk of artist displacement is higher for low-fidelity (“low-fi”), ambient-style music.

Positive trends and opportunities are also emerging, including the use of AI tools to enhance the creativity and quality of music production for amateur/independent artists. AI can be used to personalize music experiences, including curated playlists based on preferences and tailored music integration among gaming/home fitness platforms, which can increase song exploration and improve artists’ visibility. The commercial implications of these developments can include changes in licensing opportunities and payout models that provide higher monetization rates for copyright owners.

Conclusion

Being a lending partner to an established Platform with connectivity to the music industry and a prudent data-driven approach to investing is critical. Industry experience, robust origination networks and the specialized expertise of investment teams can significantly impact the success of investment outcomes.

1. Source: Goldman Sachs – Music in the Air (2025)

2. Source: MIDiA Research 2025-2032 Global Music Forecast

Endnotes

The considerations highlighted above, including with respect to the Debt Structuring Considerations and Potential Risks of Music Royalty Assets are provided for illustrative purposes only, and is not intended to be a complete discussion of the considerations and risk associated with investing in music royalty assets. Notwithstanding the advantages highlighted above, investments in music royalty assets are subject to significant risk of loss of income and capital. The above is not considered legal or investment advice, and readers are advised to consult with their own tax, legal, investment or other advisers.

Important Notices

This primer is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. All information is subject to change without notice. Northleaf’s views and opinions expressed herein should not be construed as absolute statements, do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. No representation, express or implied, is given regarding the accuracy of the information contained in this primer and there can be no assurance that any of the trends highlighted above will continue in the future. Certain of the information in this primer was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.

These materials may contain forward-looking statements based on experience and expectations about these types of investments. For example, such statements are sometimes indicated by words such as “expects,” “believes,” “seeks,” “may,” “intends,” “attempts,” “will,” “should,” and similar expressions. Those forward-looking statements are not guarantees, and are subject to many risks, uncertainties and assumptions that are difficult to predict.

This primer may not be reproduced or republished without Northleaf’s written consent. Northleaf Capital Partners and its affiliates are referred to collectively as “Northleaf” throughout this document Northleaf Capital Partners® and Northleaf® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.