Bridging Horizons: The Continuing Opportunity for Private Equity Secondaries

Recent market conditions are very likely to exacerbate private equity’s (PE) liquidity drought further and create even better conditions for secondaries investors. After three challenging years, industry participants entered 2025 expecting liquidity to return to levels last seen in the “normal” years before 2020’s COVID-19 pause, the 2021 activity spike, and the dramatic slowdown following 2022’s inflation and interest rate run-ups. These hopes have now been dashed by a trade war and ensuing uncertainty.

So, where does that leave the outlook for secondaries? Some headlines suggest a generational buying opportunity (Financial Times: “Private equity is more stuck than ever — and secondaries will benefit” - April 11, 2025), while seasoned industry veterans counsel caution, especially in the short term. Both may be correct. In the very short term, would-be sellers and buyers will rightly pause to assess the impact of a changed outlook. But this is expected only to store up more opportunities for the future. The importance of secondaries as a tool to bridge old-to-new investment horizons is likely to increase due to today’s volatility, and there should be a sustainable premium return for those who can provide liquidity.

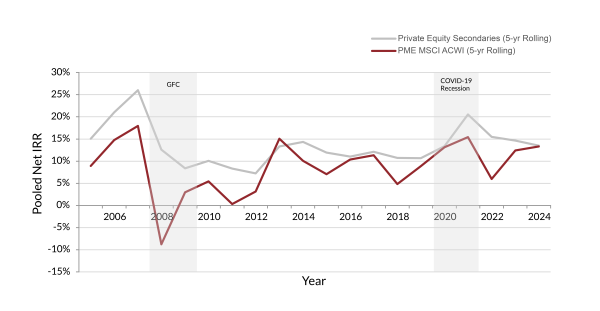

Evidence of Robust Returns

Robust returns in the face of uncertainty have helped make secondaries one of the fastest-growing and most innovative segments within private markets. Secondaries, and PE as a whole, have demonstrated consistent returns over time, often outperforming public markets by an even more significant margin during periods of economic disruption. PE-owned companies are usually smaller than their public counterparts, with value-creation drivers that are more controllable by ownership and management and typically less reliant on macroeconomic forces. This may be especially true today with PE-owned companies, especially in the middle market, which are generally less reliant on global markets and supply chains at risk from trade policy. This is also true of the PE industry as a whole, and middle-market PE in particular.

Secondaries Historically Outperform During Recessions1

Understanding the Current Landscape

The PE market has traditionally operated with a somewhat predictable timeline; allocators committed capital to be drawn over three to five years and realize returns as investments were monetized, primarily through asset sales and dividends, within four to six years after deployment. However, a prolonged drought in exits — exacerbated by macroeconomic conditions and the pandemic aftermath — has distorted this timeline, extending the liquidity horizons of many private market investments made several years prior.

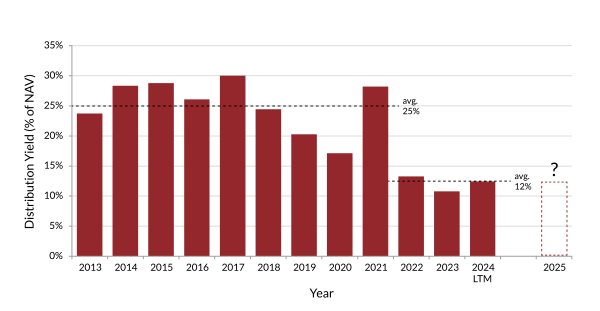

Distributions as a % of NAV

The distribution yield (how much cash an investor receives relative to the current value of their investment) is significantly lower today, averaging 12%, compared to the robust 25% seen in the teens through 2021. It seems unlikely that 2025 will deviate from the recent trend, at least not in the industry’s favor.

This extended period of slower distribution timelines puts pressure on both institutional investors (Limited Partners, or “LPs”) and on fund managers (General Partners, or “GPs”), and both may increasingly turn to secondaries as a result. Despite the recent growth, the secondaries market remains an arguably underutilized tool by LPs and GPs alike, with total activity remaining well under 3% of total industry wide asset value.2

The Institutional Investor / LP Challenge

The sustained slowdown in exits will pressure institutional investors as they struggle to commit to new funds while capital is tied up in older allocations. While these investors typically have flexibility and a long horizon, staying put exposes them to dual risks: holding allocations that would likely no longer match their institution’s objectives, and forgoing returns from newer vintages. Therein lies a substantial opportunity for secondary funds to provide liquidity, allowing investors to unlock capital from older commitments and reinvest in new opportunities.

The industry has continued to see allocators increasingly willing to accept modest but meaningful discounts as the price of this liquidity bridge. But we believe this trend has much further to run. The still relatively low adoption of secondaries sales, combined with sustained pressure on liquidity from more traditional sources, will likely result in increased sales volume at discounted prices in the future. Secondaries buyers should continue to see LP portfolios as a way to access high-quality PE assets at discounts to NAV.

The Fund Manager / GP Challenge

For GPs, the stakes are equally high. The pressure to deliver distributions to LPs is intense, particularly as LPs typically require distributions from earlier investments to commit funds to newer vintages. This demand is especially acute for middle-market funds, which have seen larger competitors, focused on larger companies, attract a higher proportion of available capital. As important, the economic turbulence experienced since 2020 has left GPs with many high-quality investments they are not ready to sell yet.

Continuation vehicles provide an elegant solution to both issues. GPs arrange these transactions to sell a “star asset” or collection of assets from a fund to a new “mini fund,” managed by the same GP and capitalized by secondaries investors. Well-structured continuation vehicles are a win-win-win: The original fund investors get an option on early liquidity; new buyers get access to these star assets at a “discount” in the form of LPs forgoing an auction premium; and GPs get cash back to investors while being able to give their star assets more time to execute their value creation plans. Secondaries funds can enable these win-win-win outcomes by bridging the objectives of the fund investors with those of the manager and can therefore command premium returns.

Considerations for Investors

For investors looking to capitalize on the current market opportunity in secondaries, there are several sweet spots that should provide favourable relative returns while effectively managing downside risk:

- Mid-Market Focus: The middle market, with mature companies ranging from $10m-$100m of EBITDA, can offer greater opportunity for operational improvements, more controllable (and local or regional) value creation drivers, and a more resilient range of exit options, as it is typically less reliant on large cap strategics and the IPO market. The middle market is also where LPs may feel the greatest need to rationalize their old positions, and where GPs will come under the most pressure, given the fundraising advantages of large aggregators.

- Quality Investments: It is essential to target funds that are nearing the end of their investment periods but have not aged excessively. The ongoing depressed exit environment means many high-quality assets remain in more recent PE vintage portfolios. But older (9+ year) vintages will usually be characterized by a disproportionate number of deals that did not work (and might not sell in any market). In an uncertain environment, manager and asset quality will be of paramount importance.

- Diversification: Diversification has never been more critical than today, when the winners and losers of the new environment may be hard to predict. By acquiring quality middle-market assets through an approach focused on building diversified portfolios, mainly through the acquisition of LP interests, investors can effectively balance opportunity with risk.

- Portfolio Construction: Experienced secondaries managers are adept at constructing portfolios that offer diversification and a relatively short horizon for capital return. These classic benefits of secondaries investing have typically been best delivered through LP portfolios. Still, good managers also know how to balance these with the right proportion of company-specific, GP-led investments to enhance overall returns without diluting the benefits of diversification and relatively quick return of capital.

Conclusion

The ongoing liquidity challenges in PE present an increasing opportunity for secondaries investors. By participating in the market and focusing on the sweet spot — diversified mid-market strategies with experienced managers — investors have the potential to gain access to high-quality assets at favourable prices. Investors made record-high commitments to PE right before COVID-19 and in its aftermath.3 They now need a bridge to a new horizon. Secondaries investors are positioned to be this bridge and continue their long track record of consistent premium returns.

Endnotes

1. Private Equity Secondaries is represented by The Cambridge Secondary Funds Index (the “Secondary Funds Index”), which represents secondaries, uses a horizon calculation based on data compiled from 334 secondary funds, including fully liquidated partnerships, formed between 1991 and 2023. Performance is annualized over rolling five-year periods. The MSCI ACWI is represented by MSCI All Country World Index - Total Return (the “MSCI Index”). This PME is used to evaluate the performance of the Secondary Funds Index against a public market benchmark or index, in this case the MSCI Index. Every capital contribution and distribution of the Secondary Funds Index is matched by an equal and timely investment and sale of the reference MSCI Index, respectively. The resulting PME IRR provides a basis for comparison against the Secondary Funds Index IRR; however, the investment strategy of the MSCI Index differs from the strategy pursued by funds representing the Secondary Funds Index, and accordingly, a direct comparison may not be meaningful.

2. Preqin Historical Fundraising and Assets Under Management search tools as derived in April 2025.

3. Preqin Historical Fundraising.

Important Notices

This article is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. Northleaf’s views and opinions expressed herein should not be construed as absolute statements, do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. No representation, express or implied, is given regarding the accuracy of the information contained in these materials and there can be no assurance that any of the trends highlighted above will continue in the future. Certain of the information in this article was gathered from various third-party sources, which Northleaf believes to be accurate but has not been able to independently verify.

This article may contain forward-looking statements based on experience and expectations about these types of investments. For example, such statements are sometimes indicated by words such as “expects,” “believes,” “seeks,” “may,” “intends,” “attempts,” “will,” “should,” and similar expressions. Those forward-looking statements are not guarantees of any future performance and are subject to many risks, uncertainties and assumptions that are difficult to predict. Northleaf has no obligation to revise or update these materials or any forward-looking statements set forth herein.

Northleaf Capital Partners® and Northleaf® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.