Private Credit Market Update: Q3-2024

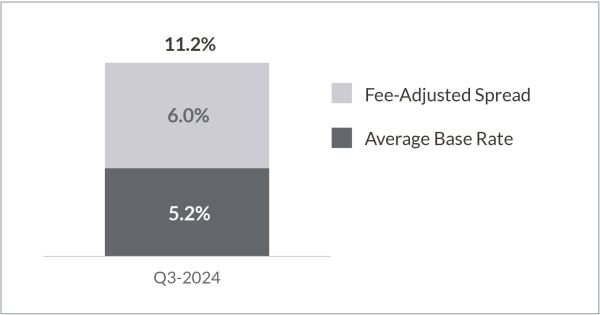

Mid-market private credit continues to deliver investors a compelling value proposition with low double-digit returns on senior secured debt with conservative structures and robust lender protections. Investor confidence and the general risk outlook is improving as private credit borrowers continue to demonstrate resilience through broader market and macro volatility.

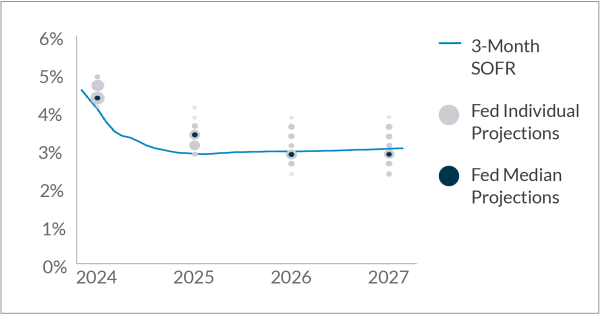

In Q3-2024, the Federal Reserve began its anticipated rate-easing cycle with a 50-bps cut following two and a half years of tightening policy. Recent economic indicators have largely been positive, but the broader risk of economic softness has not dissipated. The market continues to project that medium to long-term base rates will remain elevated compared to the historical average.

This monetary policy shift has provided incremental clarity to the macroeconomic outlook which should drive an increase in financing activity and improve the liquidity and risk profile of private credit borrowers.

Attractive Double Digit Returns

Gross Asset Yield on Senior Secured Loans

Fee-Adjusted Spread Source: Cliffwater LLC. All Rights Reserved. Reproduced with permission. Data through August 13, 2024. Sponsored Direct Lending New Issue 1L All-in Yields. Spread and 3-year amortized OID figures averaged over January 1 to August 13 to derive YTD. Average Base Rate Source: Bloomberg. Considers the 3-month term SOFR averaged over January 1 to September 30.

Base Rates Projected to Remain Elevated

Current – 2027 Projected US Base Rates

Source: Chatham Financial as of September 30, 2024. Federal Funds rate projections (overnight rate) from September 30, 2024 to December 31, 2027. There can be no assurance that any of these projections will be validated by actual events.

MARKET TRENDS

We are seeing a few trends play out in today’s private credit market:

Shifting monetary policy and stronger investor confidence has led to incremental market liquidity which is driving higher financing volumes.

Improving risk outlook is causing the market to reprice risk, with overall credit spreads tightening ~100-125 bps on new issue spreads for senior secured facilities as compared to 12-18 months ago1.

Overall borrower performance has remained resilient, demonstrated by EBITDA growth, stabilized margins and interest coverage.

Tail risk of borrowers continues to decrease, though bifurcation in industry performance is still evident.

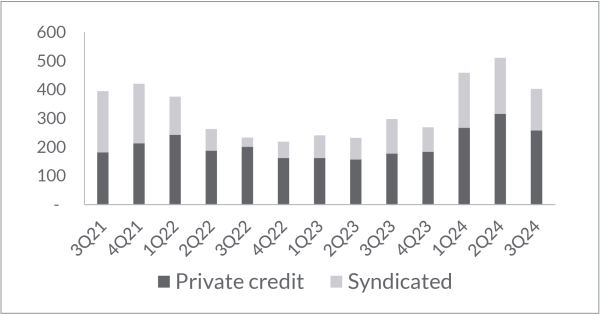

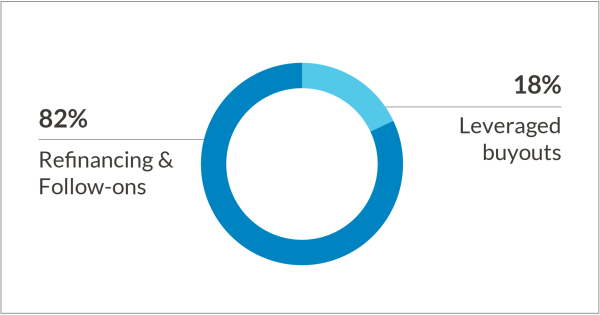

Private credit volumes continued to increase in Q3-2024 compared to prior quarters, driven largely by refinancings and add-on capital to support continued borrower growth. Following a period of dislocation, the broadly syndicated loan market is re-opening, reflecting a more positive outlook on risk. Lower interest rates should help catalyze more LBO activity, releasing pent-up transactional demand given record levels of private equity dry powder, LPs continuing to push for distributions/liquidity and improving equity valuations.

Increasing Deal Volumes

Count of US Financing Transactions

Source: Pitchbook/LCD. Data through September 30, 2024. Count is based on transactions covered by LCD News. There can be no assurance that any of the trends highlighted above will continue in the future. Excludes repricing and extension amendments; includes LBOs, refinancings and follow-ons.

Robust Demand for Refinancings/Add-On Capital; Expect Increase in LBO Activity

Type of US Financing Transactions - Last 12 Months

Source: Pitchbook/LCD. Data through September 30, 2024. There can be no assurance that any of the trends highlighted above will continue in the future.

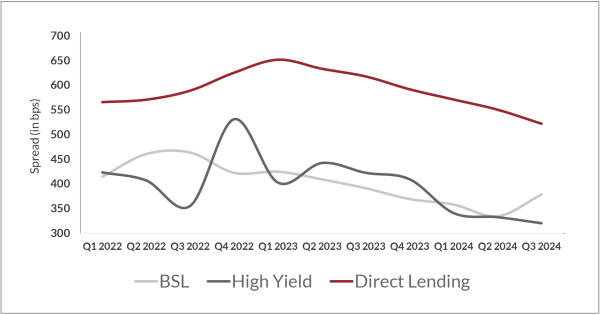

With stronger investor confidence and more liquidity, the market is repricing risk with credit spreads compressing ~100-125 bps on new issue spreads for senior secured facilities as compared to 12-18 months ago1. We have seen spread compression across the credit markets, though private credit continues to provide a healthy return premium for investors. Within private credit, the mid-market has typically remained better insulated, due to more favourable supply/demand dynamics for lenders. Pricing compression has been most pronounced in the broadly syndicated and upper mid-market due to record levels of dry powder, more competition and fewer customized structures that benefit from a pricing premium.

Private Credit Provides Attractive Return Premium

New Issue Spreads in US Broadly Syndicated Loans (BSL), US High Yield Bonds (HY), and US Direct Lending

Direct Lending Source: Cliffwater LLC. All Rights Reserved. Reproduced with permission. Data through August 13, 2024. Quarterly figures calculated as a 3-month average. BSL and High Yield Source: Pitchbook. Data through August 31, 2024. Quarterly figures calculated as a 3-month average.

Tail risk is reducing as performance remains strong and lower financing costs creates more liquidity cushion for borrowers. We have observed stronger relative value in industries with recurring revenue models, including financial services, insurance brokerage, industrial maintenance services and non-discretionary home services. These sectors tend to have visible pricing power and stable cash flows through contracted / embedded revenue streams that are not easily replaceable. We are also seeing attractive opportunities in asset-based specialty finance, specifically in niche sectors that require asset specialization and bespoke structuring, and consequently have less coverage from traditional capital providers.

We do expect bifurcation of performance across certain pockets of the industry that are showing some softness, such as healthcare, consumer discretionary and highly levered businesses. The long-term outlook for healthcare remains favourable, but inflationary pressures have weighed on margins of companies with revenues linked to reimbursement rates. We are starting to see signs of margin stabilization within healthcare, though we remain cautious.

Market defaults in Q3-2024 improved from the prior quarter, with the trailing 12-month default rate of the Morningstar LSTA US Leveraged Loan Index (LLI) ending the quarter at 1.3%, as compared to 1.6% in Q2-2024. In select instances where borrower liquidity is tighter, we have seen private equity sponsors support their portfolio companies with additional capital.

Overall, private credit has remained resilient and has provided investors with attractive risk-adjusted returns and contractual cash yield. In particular, mid-market private credit has historically delivered lower loss rates relative to public debt investments over the long term due to conservative structures and strong lender protections.

1. Source: Cliffwater LLC. All Rights Reserved. Reproduced with permission. Data as of August 13, 2024. Direct Lending New Issue 1L Spreads.

Important Notices: This document is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf-managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. The views and opinions expressed herein do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. There can be no assurance that any of the trends highlighted above will continue in the future, Certain of the information set forth herein was gathered from various third-party sources which Northleaf believes to be accurate, but has not been able to independently verify.

“Cliffwater,” “Cliffwater Direct Lending Index,” and “CDLI” are trademarks of Cliffwater LLC. The Cliffwater Direct Lending Indexes (the “Indexes”) and all information on the performance or characteristics thereof (“Index Data”) are owned exclusively by Cliffwater LLC, and are referenced herein under license. Neither Cliffwater nor any of its affiliates sponsor or endorse, or are affiliated with or otherwise connected to, Northleaf Capital Partners, or any of its products or services. All Index Data is provided for informational purposes only, on an “as available” basis, without any warranty of any kind, whether express or implied. Cliffwater and its affiliates do not accept any liability whatsoever for any errors or omissions in the Indexes or Index Data, or arising from any use of the Indexes or Index Data, and no third party may rely on any Indexes or Index Data referenced in this report. No further distribution of Index Data is permitted without the express written consent of Cliffwater. Any reference to or use of the Index or Index Data is subject to the further notices and disclaimers set forth from time to time on Cliffwater’s website.