Asset-Based Specialty Finance Spotlight: Lending Against Commercial Legal Assets

Commercial Legal Assets

Commercial legal assets are investments collateralized by anticipated settlement proceeds of litigation claims, or a portfolio of claims. Typically, transactions are structured as non-recourse funding agreements between litigation funders (“Funders” or “Platforms”) and plaintiffs or law firms, to finance out-of-pocket legal and working capital expenses associated with pursuing meritorious commercial claims. In exchange, claimants or law firms agree to pay Funders a portion of settlement proceeds from successful case outcomes, providing a return on Funders’ capital. If claims are unsuccessful, Funders typically do not have any recourse and are not entitled to payment.

The underlying claim investments are typically structured conservatively by advancing against a small portion of the anticipated settlement value (typically ~10-20%). Funders originate and service highly diversified portfolios of unique claims to mitigate binary case outcomes. Lenders will lend against these diversified portfolios at even more conservative loan-to-values, providing further insulation from potential value deterioration arising from unsuccessful case outcomes. Lending structures will define and enforce strict eligibility requirements and concentration limits that align with a Funder’s track record to ensure quality and diversification are maintained within the underlying portfolio of claims.

Unlocking Value through Debt-Focused, Niche Asset-Based Specialty Finance

Asset-based specialty finance (“ABSF”) sits in a unique part of the private credit landscape from a risk/return perspective. While the return profile can often align with opportunistic or distressed strategies, ABSF is typically collateralized by portfolios of performing assets, consistent with traditional lending. The market is commonly segmented into: (1) consumer, (2) commercial and (3) niche asset categories. Each of these segments offer investors unique and diversified exposure with varying return, correlation and risk characteristics.

A debt-oriented focus on niche assets represents a particularly interesting intersection within the ABSF opportunity set, with well-structured investments offering the potential for enhanced yield, diversified collateral coverage and lender protections. Underwriting is granular and specialized while borrowers often seek bespoke and customized structures. This creates natural barriers to entry for traditional capital providers such as banks and generalist pools of institutional capital.

Industry Overview

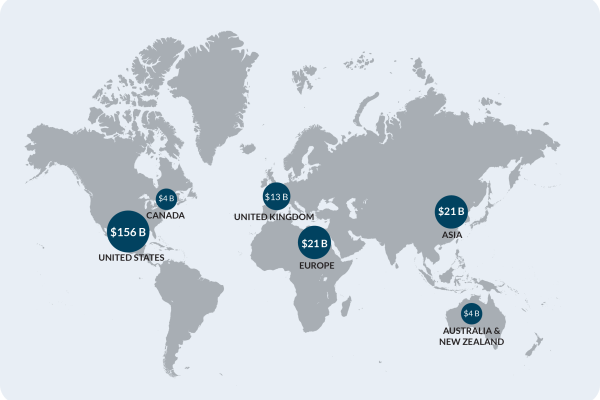

The estimated total addressable share of the global legal market is $220 billion1. Market growth catalysts have included broader awareness of legal funding options, the rising cost and emerging areas of litigation, and a maturing regulatory landscape. Today, the most mature markets for legal funding are North America, Europe, the UK and Australia– jurisdictions with well-established legal systems, strong precedents in case outcomes, and ability to enforce judgements. Commercial legal case outcomes have a very low correlation with broader macroeconomic drivers, while the specialization required to underwrite and structure investments creates high barriers to entry.

Law Firm Funding vs. Commercial Litigation Funding

There are two primary funding verticals: (a) funding for law firms, provided by Law Firm Funders and (b) funding for plaintiffs, provided by Commercial Litigation Funders.

- Law Firm Funders specialize in originating and servicing loans to law firms. Law firms typically represent, on a contingency fee basis, individual claimants in large-scale, nationwide mass tort claims, class actions, and single-event personal injury cases. Due to the contingency fee nature of these cases, funding is used by law firms to monetize expected fee income to provide liquidity to the law firm, as well as reduce the financial risk of pursuing these cases.

- Commercial Litigation Funders specialize in originating and servicing loans to plaintiffs involved in commercial claims with strong prospects of success. Each loan is subject to a strict litigation budget that supports strong counterparty alignment and unlocks over time as the claim progresses.

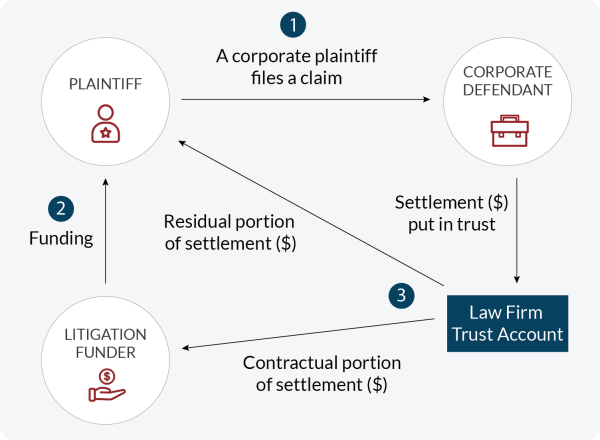

Commercial Litigation Funding Example

- Commercial claim: A corporate plaintiff files a claim, typically against a corporate or government entity and seeks damages.

- Litigation funding: The plaintiff seeks funding from a Commercial Litigation Funder to fund claim pursuit expenses, such as hourly lawyer fees, expert testimony and other out-of-pocket expenses. In exchange for providing capital to pursue the claim, the plaintiff agrees to pay the Funder a portion of settlement proceeds upon successful resolution of the case. This agreement is memorialized in a Litigation Funding Agreement which details the budget supporting the claim and the associated economics.

- Payment waterfall: The Funder is typically entitled to a ~2-4x multiple on advances/invested capital for prevailing claims. If the case is unsuccessful, there is no recourse to the plaintiff and the Funder is not entitled to payment. The Funder ranks senior in the settlement distribution waterfall over the plaintiff. Given courts typically require claim settlements to flow through a law firm’s trust account, Funders require the law firm to either be party to the Litigation Funding Agreement or sign a priority of payments agreement which allows compliance with the distribution waterfall.

Type and Timing of Cases

Given each claim type has a different risk/return profile and expected duration to settlement, Funders seek to build portfolios of claims diversified by claim type, jurisdiction, and commitment amount to help mitigate single case or binary exposure. As an example, intellectual property claims are typically more complex with longer duration expectations. These types of fundings would be structured with higher returns (i.e., a higher agreed upon settlement portion) for Funders to compensate for the expected duration risk. Smaller commercial cases are more typical for Funders as the case fact patterns and precedents are often clear, leading to more predictable duration expectations.

Funding can occur “pre-settlement” against the expected outcome of an unresolved case or “post-settlement” after the case has settled but while the plaintiff or law firm is awaiting settlement proceeds. The risk profile and expected duration is different and therefore the expected return on capital should be higher in “pre-settlement” fundings.

Funding Platform Considerations

Key Funder or Platform attributes to diligence when providing financing include but are not limited to:

- Track record of successful claim outcomes

- Access to a consistent pipeline of high-quality cases via diversified origination and relationship channels

- Comprehensive underwriting systems that uphold high risk management standards.

- Seasoned management teams with deep legal backgrounds and expertise

- Operations based in developed economies with established regulatory and legal systems and certainty of enforcement

Debt Structuring Considerations

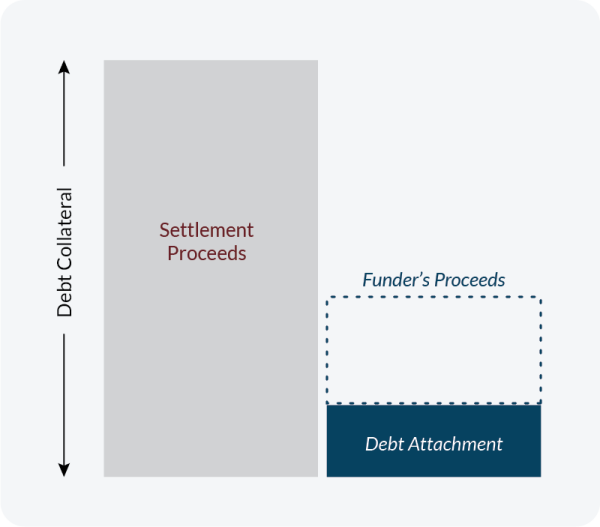

The debt position in a Funder’s capital structure offers a compelling value proposition due to the potential for attractive yield, diversified collateral base, conservative loan-to-value, priority repayment, and downside management.

In the context of a scaled portfolio with hundreds of claims, each with uncorrelated case facts, the collateral pool is highly diversified, which reduces the risk of binary outcomes. Furthermore, lenders typically lend against the Funder’s cost basis at a meaningful discount, which supports strong alignment with expected capital preservation even if only a small portion of claims are successful.

Illustrative Lender Collateral

Lender Protections

Debt investments benefit from robust lender protections such as wide-ranging financial covenants. In addition, eligibility criteria and concentration limits are used to ensure the collateral pool is well-diversified. Frequent and defined reporting packages offer granular, real-time monitoring of asset performance and a high degree of information access.

Duration risk can be appropriately managed as the tenor of the loan typically aligns with the average settlement timeline, typically three to five years. Additional protections may include cash sweep provisions, minimum MOIC and insurance wrappers.

Potential Risks of Commercial Legal Assets

All investments carry some degree of risk. With commercial legal assets, unsuccessful case outcomes or longer case duration are key asset-level risks that might be borne by the Funder. Platforms with highly experienced teams, proven underwriting rigour and case management/monitoring processes can typically manage the risk of outsized losses or extended case duration relative to industry standards. Furthermore, debt investments should be structured with attractive loan-to-values to mitigate risk of underperformance.

In addition, legal assets are highly specialized investments to underwrite, structure, and monitor. High-value claims are inherently complex and evolve over their 3 to 5-year lifespan. It is critical for the Funder to manage counterparty alignment and the budget effectively. A mismanagement of the budget can result in overfunding or unintentionally creating misalignment issues between parties in an ongoing claim. Partnering with a seasoned Funder who has navigated a wide range of legal asset cases is crucial. Industry experience, robust origination networks, and the expertise of investment teams can significantly impact the success of investment outcomes.

Endnotes

The examples highlighted above, including with respect to Lender Protections, Lender Collateral and Lender Funding are for illustrative purposes only. Accordingly, ABSF deals may exhibit all, some or none of the characteristics highlighted above.

1. As per Omni Bridgeway and Northleaf estimates. Data as of June 2023.

Important Notices

This primer is for informational purposes only and does not constitute a general solicitation, offer or invitation in any Northleaf managed product in the United States or in any other jurisdiction and has not been prepared in connection with any such offer. All information is subject to change without notice. Northleaf’s views and opinions expressed herein should not be construed as absolute statements, do not constitute investment or any other advice, are subject to change, and may not be validated by actual events. No representation, express or implied, is given regarding the accuracy of the information contained in this primer and there can be no assurance that any of the trends highlighted above will continue in the future. Certain of the information in this primer was gathered from various third-party sources which Northleaf believes to be accurate but has not been able to independently verify.

These materials may contain forward-looking statements based on experience and expectations about these types of investments. For example, such statements are sometimes indicated by words such as “expects,” “believes,” “seeks,” “may,” “intends,” “attempts,” “will,” “should,” and similar expressions. Those forward-looking statements are not guarantees, and are subject to many risks, uncertainties and assumptions that are difficult to predict.

This primer may not be reproduced or republished without Northleaf’s written consent. Northleaf Capital Partners and its affiliates are referred to collectively as “Northleaf” throughout this document Northleaf Capital Partners® and Northleaf® are registered trademarks of Northleaf Capital Partners Ltd. All rights reserved.